Software solutions | Senior living | Financial management

Best Accounting Software Solution for Senior Living Organizations

January 23, 2024

|

Making sound decisions about cash management is crucial for the lasting success of any senior living community, residential care home, or assisted living community. While integrating cash management or accounting management solutions for senior living might seem like a time-consuming process, it is an essential practice that promises substantial returns on your investment.

What Is Cash Management?

Cash management involves overseeing and supervising cash flows and plays a pivotal role in maintaining the financial health and stability of any organization.

Under the umbrella of cash management, various tasks need attention, including:

- Calculating the cost of all expenses

- Optimizing the utilization of cash

- Minimizing excess cash

- Establishing reserves and contingency funds

- Scrutinizing spending

- Tracking receipts

Effective cash management for your senior living organization ensures that you always have the necessary funds to cover expenses, such as:

- Payroll

- Debt repayments

- Interest on loans

- Bank fees

- Rent

- Utilities

- Insurance expenses

- Extraneous expenditures

Failure to meet these expenses can spell disaster for any business, especially nonprofits, where the margins are often razor-thin.

Tip #1: Assess management solutions for your senior living organization.

Choosing the right cash management solution can be overwhelming and nerve-racking due to the myriad options available. Additionally, the cost of such software can seem prohibitive.

For these reasons, many organizations wind up using older, more familiar cash management options such as QuickBooks or Excel spreadsheets or even their online freeware counterparts. While these options may seem safe, secure, and cost-effective, they may not provide the insights and flexibility you need from your senior living accounting software, and they have some serious drawbacks.

When using Microsoft Excel and QuickBooks, you may encounter:

- Lack of collaboration opportunities

- Manual processes prone to human error

- Lack of version control

- Time-consuming manual data entry

- Difficulty in predicting accurate cash flow

- Potential for errors across dueling spreadsheets

- Limited spreadsheet scalability

These limitations can negatively impact your organization.

Given the financial realities facing the senior living industry, effective cash management is imperative. Fortunately, there are numerous accounting software solutions, such as Sage Intacct, that are customizable for senior living organizations and can help manage past, present, and future cash flows.

Tip #2: Look for financial solutions for senior living that integrate with your existing systems.

The best accounting management solutions for senior living organizations seamlessly integrate with your current accounting software, extracting data from income statements and balance sheets to create comprehensive cash flow statements and reports. This automated process offers convenient, real-time insights into the cash management of your facilities.

Tip #3: Find a partner specializing in financial solutions and senior living payment processing.

Ensuring the appropriate decision-making in cash management is vital for the enduring growth and success of your senior care community. Although adopting cloud-based accounting software tailored to cash management for senior living may seem like a tedious and complicated process, a comprehensive evaluation of your cash management software needs is essential when selecting the best option for your specific situation.

For more than 25 years, enSYNC has been assisting nonprofit and charitable organizations in harnessing the power and potential of technology.

When you partner with us, you can expect a comprehensive range of services and ongoing support to effectively implement and optimize financial solutions for senior living organizations. This includes, but is not limited to:

- Personalized strategy, configuration, and optimization of your system.

- Defined roadmap for implementation guided by an expert.

- Secure data migration.

- Partner-led training and user adoption support.

- Post-implementation support long-term.

With a proven history of helping nonprofits, we stand ready to assist you in selecting a cash management solution that not only saves you time and enhances your efficiency but also aids in the reduction of costs as well.

Improve Your Cash Management with enSYNC’s Financial Solutions for Senior Living Organizations

Contact us for a complimentary assessment to find out how to unlock the possibilities financial solutions for senior living organizations have to offer.

Chadd Arthur is a seasoned professional with over 25 years of experience in the non-profit sector, specializing in process improvement and the strategic alignment of organizational goals with technology solutions. Leveraging his extensive expertise, Chadd conducts regular strategic assessments for organizations, guiding them towards enhanced efficiency and effectiveness. With a profound passion for aiding clients in recognizing the value of process improvement, Chadd leads our team in secure technology solutions that directly contribute to their mission success. His commitment to excellence is evident in his contributions to the industry, including participating in panels and serving as a thought leader to a network of non-profit professionals. Chadd earned his MBA from Indiana University Bloomington and resides outside the greater Chicago area. Chadd not only brings a wealth of knowledge and experience but also a dedication to making a meaningful impact in the non-profit space.

Recent Posts

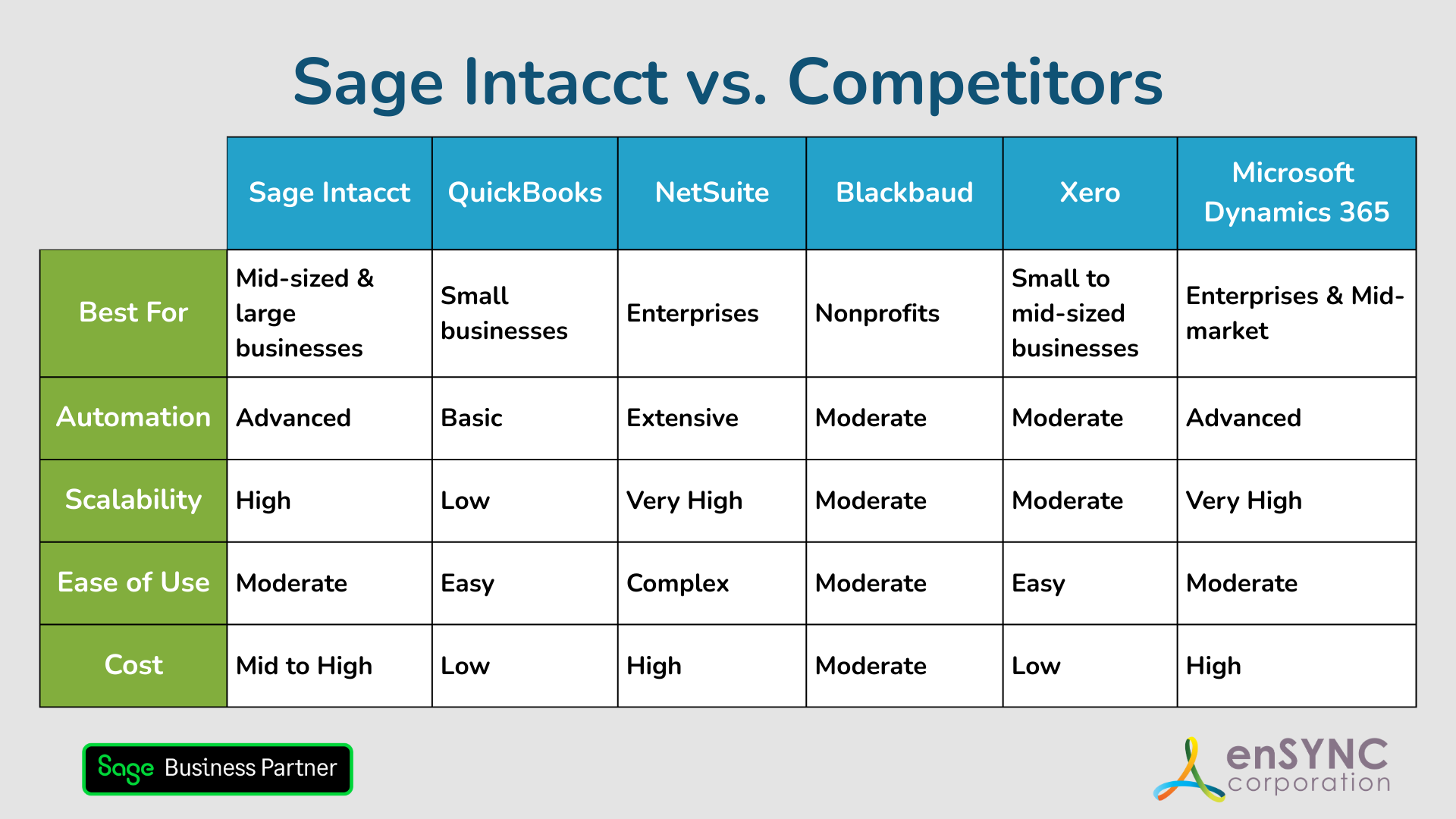

Sage Intacct vs. Competitors: Finding the Best Accounting Solution for Your Nonprofit

Choosing the right accounting software is a critical step for any organization — and a deeply personal one, too. How to choose the accounting...

How Sage Intacct Transforms Nonprofit Financial Management: A Complete Guide

Staying on top of financial management is crucial for all businesses, especially nonprofits. Nonprofits often have limited resources and handle...

Enjoying our blog?

At enSYNC, we want to empower associations and nonprofits to make well-educated decisions. If you want our industry knowledge (and other free guides) sent directly to your inbox, fill out the form below.