Technology & digital transformation | Senior living | Financial management

Cloud Financial Management for Senior Living Organizations

February 13, 2024

|

In an era of digital transformation, the cloud has emerged as a game-changer for various industries, including senior care. As these organizations strive to enhance efficiency, cut costs, and improve overall financial health, accounting management solutions for senior living organizations is crucial for sustained success. Changing accounting software is no easy task, but it is worth the time and effort. In the end, this shift to cloud-based accounting will pay dividends.

Diving into all the nuances of these new systems and technologies can be daunting. However, the more you learn, the better you’ll be at addressing your senior living organization's specific needs. Knowing what to look for is the first step in figuring out how to best utilize cloud financial management.

A New Approach to Accounting Software Solutions

Traditionally, senior living organizations have relied on locally accessible financial systems, which often proved cumbersome and limited scalability. Cloud financial management offers flexibility, accessibility, and real-time insights to those looking to streamline complex financial processes.

Cloud-based accounting software solutions also integrate seamlessly with healthcare management systems, which can improve the overall efficiency of healthcare services. This enables organizations to centralize financial data and expand accessibility across their teams. The new approach enhances collaboration, offering seamless communication between finance, administration, and healthcare teams. [H2] Top 3 Ways to Utilize Cloud-Based Accounting Software Solutions for Senior Living

Senior living organizations face unique financial challenges. Cloud-based financial software offers many solutions to these challenges and can be utilized for:

- Compliance and risk mitigation

- Healthcare cost optimization

- Resident fee management

1. Compliance and Risk Mitigation

Senior living organizations operate within a regulatory framework that demands adherence to strict financial standards. Cloud financial systems can be tailored to meet industry-specific regulations and reduce the risk of legal and economic setbacks. Reduced risk means improved service and long-term success.

Automated compliance checks, real-time reporting, and audit trails are all key features that help senior living organizations stay ahead of regulatory requirements. Staying compliant ensures economic stability and fosters trust among residents, families, and regulatory bodies, all of which are crucial in senior care.

2. Healthcare Cost Optimization

Healthcare costs comprise a significant portion of any senior living organization’s budget. With cloud-based financial software, teams can use data-driven insights and advanced analytics to identify trends, forecast future needs, and implement cost-effective measures. Sharing information between different teams allows for out-of-the-box brainstorming and problem-solving.

Because cloud accounting software solutions can integrate with most healthcare management systems, it can improve the overall efficiency of healthcare services. This means more accurate tracking of all healthcare expenses, which creates more efficient operations and improved quality of care for residents.

3. Resident Fee Management

Managing resident fees is a critical financial sustainability aspect for senior living organizations. Cloud-based accounting can be customized to automate billing processes to ensure more accurate and timely invoicing. This minimizes errors and enhances transparency. As a result, residents and their families can track and understand the charges incurred.

Additionally, cloud-based systems can integrate with electronic health records (EHR) to provide a holistic view of residents' financial and healthcare information. This proactive financial planning allows organizations to anticipate and address potential challenges in managing resident fees.

Learn How enSYNC Empowers Senior Living Organizations with Sage Intacct

Cloud financial management for senior living organizations are dynamic tools that offer exceptional value when expertly utilized. enSYNC uses Sage Intacct to help senior living organizations like yours capitalize on all the benefits of cloud financial management.

Whether you need to manage your finances, optimize your healthcare costs, ensure compliance with regulations, mitigate financial risk, or all the above, our experts at enSYNC are here to help.

Contact us to learn more about what Sage Intacct can do for your senior living organization.

Chadd Arthur is a seasoned professional with over 25 years of experience in the non-profit sector, specializing in process improvement and the strategic alignment of organizational goals with technology solutions. Leveraging his extensive expertise, Chadd conducts regular strategic assessments for organizations, guiding them towards enhanced efficiency and effectiveness. With a profound passion for aiding clients in recognizing the value of process improvement, Chadd leads our team in secure technology solutions that directly contribute to their mission success. His commitment to excellence is evident in his contributions to the industry, including participating in panels and serving as a thought leader to a network of non-profit professionals. Chadd earned his MBA from Indiana University Bloomington and resides outside the greater Chicago area. Chadd not only brings a wealth of knowledge and experience but also a dedication to making a meaningful impact in the non-profit space.

Recent Posts

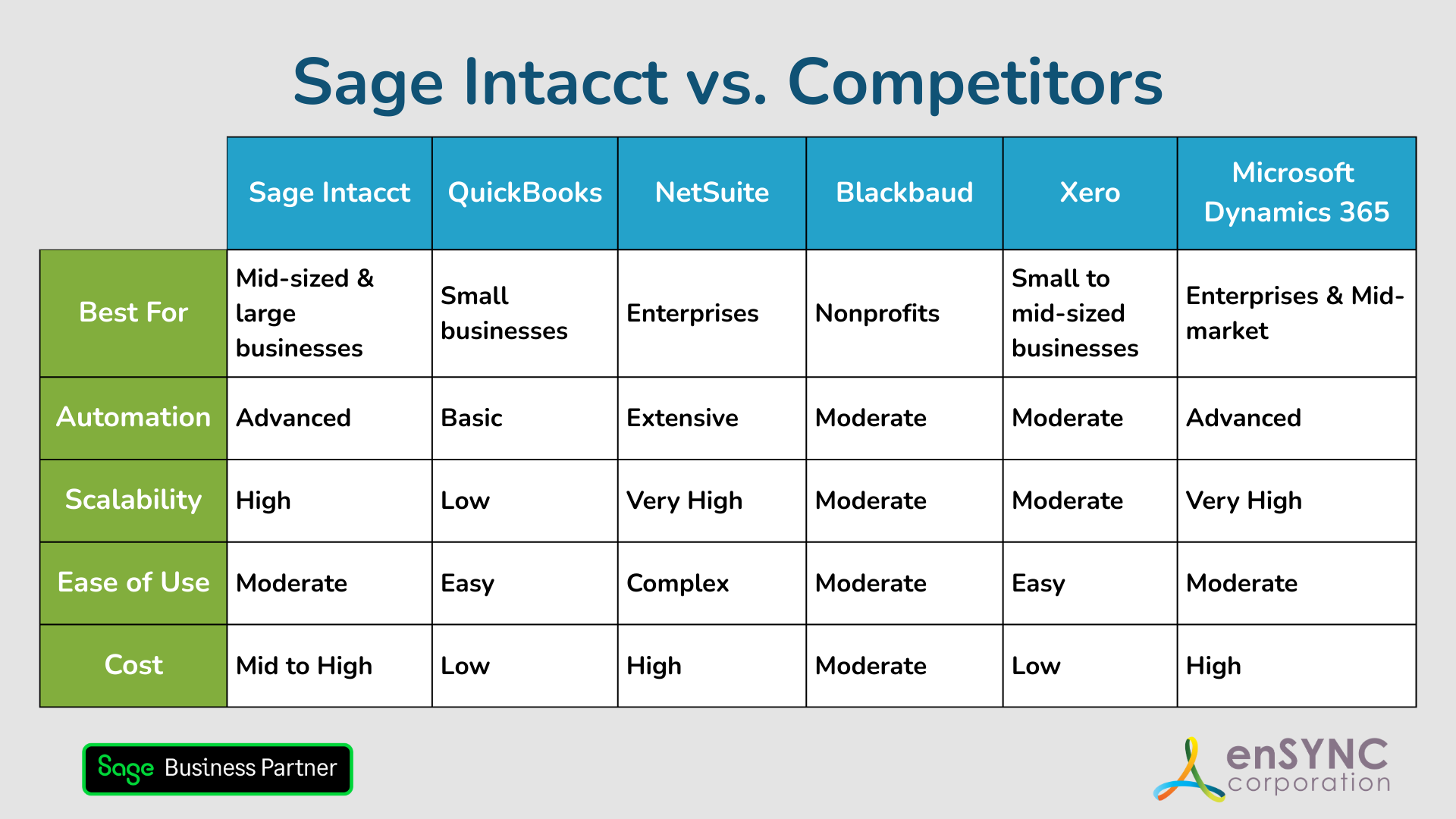

Sage Intacct vs. Competitors: Finding the Best Accounting Solution for Your Nonprofit

Choosing the right accounting software is a critical step for any organization — and a deeply personal one, too. How to choose the accounting...

How Sage Intacct Transforms Nonprofit Financial Management: A Complete Guide

Staying on top of financial management is crucial for all businesses, especially nonprofits. Nonprofits often have limited resources and handle...

Enjoying our blog?

At enSYNC, we want to empower associations and nonprofits to make well-educated decisions. If you want our industry knowledge (and other free guides) sent directly to your inbox, fill out the form below.