Strategy & planning | Senior living | Financial management

Cost Management Strategies for Senior Living Communities

June 4, 2024

|

Deploying effective cost management strategies in senior living management means accounting for a variety of interlinked needs and demands between departments to balance quality of care with cost savings.

Beyond diverse internal needs, senior living communities are also faced with unique external financial challenges including rising care demands, shifting regulatory environments, insurance coverage changes, and increasing operational expenses. While ultimately the health and well-being of residents and members is the focus, managing operational cost is essential to ensure the longevity and effectiveness of the care.

Due to all of the above, senior living leaders are faced with this core question — how do we maximize and expand personalized care services without exponentially increasing costs? Below we'll explore some key cost management strategies for senior living communities that can help you overcome these challenges and find the best possible solution. We also encourage you to seek senior living organization consulting services that can help guide you and your team through this process.

Follow Best Practices: Core Strategies for Cost Reduction

Senior living teams need the foresight to adapt to changing rules while using regulatory frameworks to their advantage. Succeeding in the senior care industry requires a strategic approach to managing finances. Organizations must craft comprehensive plans that align with their mission and vision, setting the trajectory for a sustainable future.

Below are components of strategic financial planning to provide a roadmap for achieving long-term fiscal health.

- Establish Clear Financial Goals: Define clear financial objectives that resonate you’re your organization’s mission to set the foundation for a focused and effective financial strategy.

- Approach Budgeting Strategically: Develop a budget that reflects the true cost of quality care while remaining realistic and flexible. Strategic budgeting techniques can help achieve this balance.

- Use Data to Make Decisions: An understanding of financial sustainability requires data visibility. Transparent reporting empowers decision-makers with the information they need to reduce waste and optimize resource allocation.

- Diversify Revenue Streams: Relying on a single source of income is a risky proposition. Diversifying revenue streams can offer stability and create new opportunities for financial growth.

Remain Fluid: Monitoring and Adapting to Financial Trends

Macroeconomic trends can impact a senior living community’s financial viability. Organizations need to remain vigilant, anticipate changes, and adjust their strategies for cost reduction accordingly.

Below are some adaptive strategies that can protect an organization against external financial uncertainty and change.

- Proactive Financial Analysis: Regular analysis of financial data can reveal early signs of impact from external trends. With this approach your team will be equipped to preemptively address potential financial challenges.

- Building Flexibility into Financial Plans: Rigid financial plans are susceptible to disruptions. By building in flexibility, senior living organizations can adapt quickly to changing market conditions.

- Participating in Industry Benchmarking: Industry benchmarking provides a point of reference to evaluate an organization’s financial performance against its peers. This comparative analysis can offer valuable insights and identify areas for improvement.

The financial stability of a senior living community is part of the commitment to sustainable, quality care. By implementing strategies for cost reduction and instilling a drive toward financial acumen, a senior living community safeguards its future and enhances the quality of life for its residents and their families.

Is Your Technology Fully Supporting Your Cost Management Goals?

Effective cost management strategies in senior living are pivotal to your organization's success, and the technology you use plays a critical role. With access to features like comprehensive reporting and real-time data analytics, the right system is key to optimizing your processes.

Don’t miss out on the opportunity to transform your budgeting and cost management practices. Connect with our experts today to discover how solutions like Sage Intacct can elevate your financial strategy.

Chadd Arthur is a seasoned professional with over 25 years of experience in the non-profit sector, specializing in process improvement and the strategic alignment of organizational goals with technology solutions. Leveraging his extensive expertise, Chadd conducts regular strategic assessments for organizations, guiding them towards enhanced efficiency and effectiveness. With a profound passion for aiding clients in recognizing the value of process improvement, Chadd leads our team in secure technology solutions that directly contribute to their mission success. His commitment to excellence is evident in his contributions to the industry, including participating in panels and serving as a thought leader to a network of non-profit professionals. Chadd earned his MBA from Indiana University Bloomington and resides outside the greater Chicago area. Chadd not only brings a wealth of knowledge and experience but also a dedication to making a meaningful impact in the non-profit space.

Recent Posts

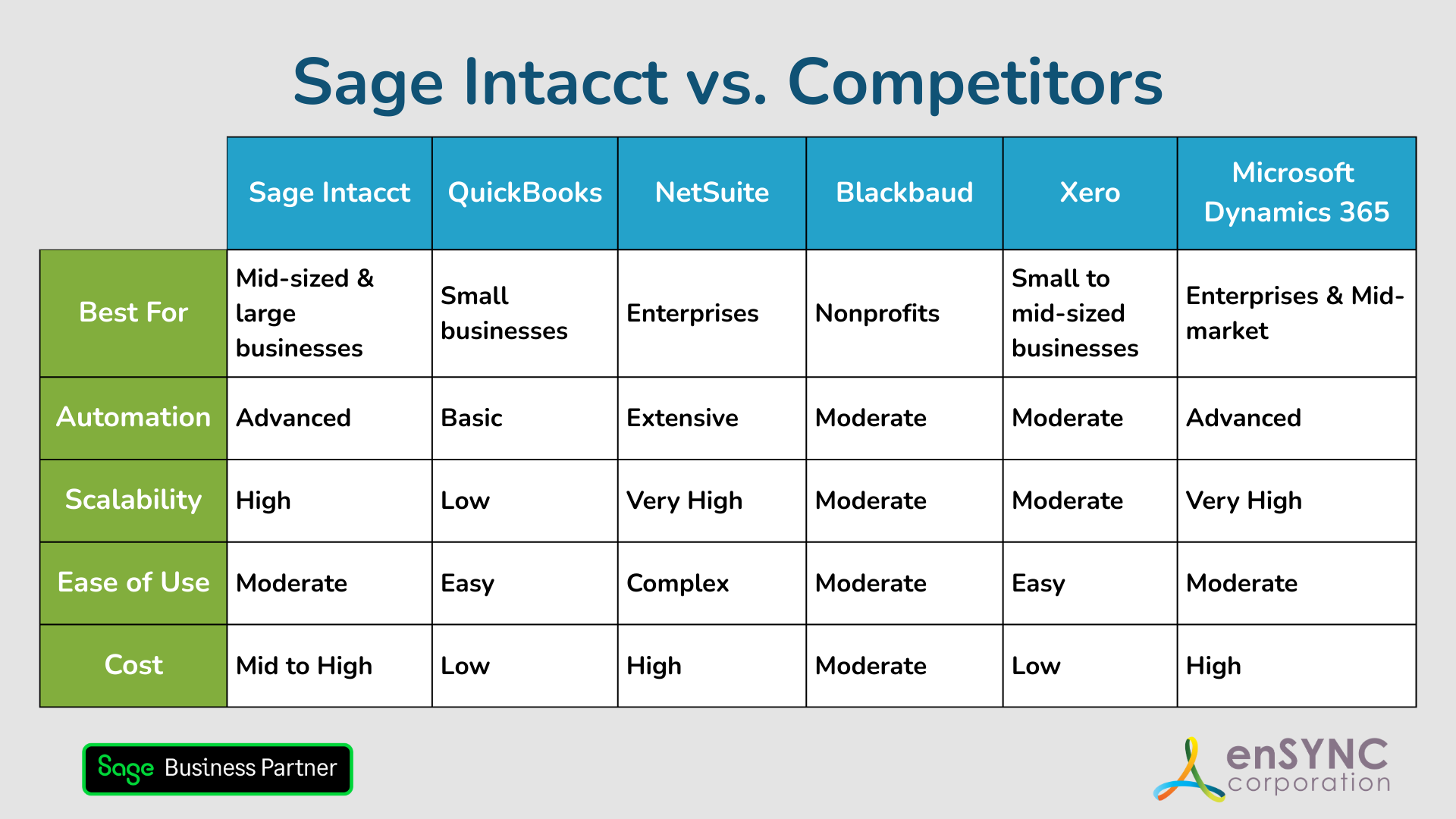

Sage Intacct vs. Competitors: Finding the Best Accounting Solution for Your Nonprofit

Choosing the right accounting software is a critical step for any organization — and a deeply personal one, too. How to choose the accounting...

How Sage Intacct Transforms Nonprofit Financial Management: A Complete Guide

Staying on top of financial management is crucial for all businesses, especially nonprofits. Nonprofits often have limited resources and handle...

Enjoying our blog?

At enSYNC, we want to empower associations and nonprofits to make well-educated decisions. If you want our industry knowledge (and other free guides) sent directly to your inbox, fill out the form below.