Webinar | Technology & digital transformation | Grant & fundraising | Nonprofits & associations

How Fundraising Management Software Helps Donation Tracking

April 21, 2023

|

Donations are critical to keeping nonprofit organizations operational so they achieve their mission. However, tracking donations can be challenging as your organization grows and compliance requirements increase. This article summarizes some best practices for tracking donations and how technology helps streamline the process.

Why Tracking Donations Can Be Challenging

Let’s first identify some of the challenges nonprofit managers face when tracking donations:

Donations come from many sources.

Nonprofits receive donations from various sources, including:

- Individuals

- Government agencies

- Corporations

- Foundations

Tracking donations from different sources can be time-consuming and resource-intensive. Modern fundraising management software can help organize where your donations come from to simplify tracking and maintain compliance.

There are many donation types.

Technology has made giving easier through the Internet, however donations now come in many forms, including:

- Cash

- Credit/debit cards

- Cheques

- Stock transfers

- In-kind donations

- Cryptocurrency

Different donation types often require a different accounting procedure when recording and reporting the transaction. This is required in order to stay compliant with regulations and conform to Generally Accepted Accounting Principles (GAAP).

Nonprofits must demonstrate accountability to donors.

Donors expect accountability and transparency to ensure their contributions are being used appropriately. As a result, nonprofits must maintain strong donor relationships by demonstrating that funds are being distributed in an efficient and effective way.

Managing donor information can be complex.

Managing donor information can be challenging without an effective membership management system that collects and maintains data. Cross-referencing donor transactions with user data is additionally time and resource-intensive - especially without integrations that sync different software systems.

Nonprofits must maintain compliance.

In order to stay compliant, most nonprofit organizations must comply with specific rules and regulations. These can include registering with state agencies, adhering to data privacy rules, and reporting fundraising activities. Compliance management is especially complex for larger organizations operating in multiple jurisdictions.

Donations are separate from other types of funding.

Donations must be tracked and processed differently from other nonprofit funding sources such as grants, membership fees, sales revenue, and fundraising events. Since donations are given voluntarily without the receipt of a product or service, they are subjected to different accounting rules.

IRS Qualifications for Accepting Donations

In order to qualify as a tax-exempt organization under section 501(c)(3) of the Internal Revenue Code, the Internal Revenue Service (IRS) requires that nonprofit organizations fulfill the following requirements:

- The nonprofit must be structured as a corporation, trust, or unincorporated association.

- The organization must have a charitable purpose as per the organization's bylaws or articles of incorporation.

- The nonprofit must operate for the public’s benefit and not provide any private benefit to individuals or other organizations.

- The organization must not engage in political campaigns and must limit lobbying activities to an insubstantial part of its operations.

- The organization must file annual returns (including Form 990) and maintain adequate financial records.

- The organization must not engage in activities that provide surplus benefits to insiders, including directors, officers, or managers.

Following the above criteria is required if nonprofit organizations want to receive tax-deductible donations. Failure to meet these requirements may result in losing the tax-exempt status and incurring penalties and fines.

Restricted and unrestricted donations must be tracked differently.

Restricted donations given to a nonprofit organization typically have specific instructions restricting how funds are used. In contrast, unrestricted donations can be used freely by the organization in accordance with its mission.

Tracking restricted and unrestricted funds differs in how the money is managed and reported. Nonprofits often use unrestricted donations as general operating funds whereas restricted donations are typically allocated to specific funds in the organization's financial system.

Accounting Procedures for Collecting and Reporting Donations

Accounting procedures differ among organizations, however most follow standard procedures that include:

- Setting up an account in their books for tracking donations and related expenses

- Recording donations when received, including the date, donor name, amount, restrictions, and conditions

- Separating restricted and unrestricted donations and allocating them to an appropriate fund

- Recognizing donation revenue according to GAAP

- Disclosing donations receive in financial statements

- Tracking and reporting expenses related to fundraising campaigns, including promotional materials and events

Rules for Donation Accounting

Donations are subject to special tracking rules that include:

Tax-Exempt Status

Unlike income from sales or membership fees, most donations received by nonprofits are not subject to taxes.

Restricted vs. Unrestricted Reporting Requirements

Some donations come with restrictions or conditions imposed by the donor or law. As a result, the money is typically assigned to a fund prior to disbursement. In contrast, unrestricted donations are typically reported when received and often disbursed where required.

Maintenance of Donation Records

Nonprofit organizations are required to keep donation records that include the date, amount, and donor information. Managers additionally must record any restrictions or conditions attached to the donation if applicable.

Provision of Written Acknowledgement

Unlike other types of revenue, nonprofits are required to provide written acknowledgment for donations received, including information about the organization’s tax status.

How Nonprofits Use Technology To Streamline Donation Tracking

Technology can streamline donation tracking in several ways:

Electronic Payment Processing

Platforms like Stripe and Paypal offer online donation forms and secure payment processing in exchange for a debit and credit card processing fee per transaction. Many of these platforms additionally integrate with software systems when sending data to minimize errors and reduce the need for manual data entry.

Automated Receipt Generation

Charitable organizations are required to provide acknowledgment letters stating their tax-exempt status. Using donation software and payment processing platforms can save time by automatically generating receipts and acknowledgment letters that contain the information required to maintain compliance.

Online Fundraising Platforms

Online donation platforms like GoFundMe can be used to solicit donations, manage crowdfunding campaigns, and collect payments. Rather than charging a platform fee, most systems deduct a payment processing fee per donation.

Many nonprofits choose crowdfunding platforms because they offer tools such as fundraising thermometers, social media integrations, and sharing buttons. Most platforms additionally provide analytics and reporting capabilities that help marketing teams gauge the success of the fundraising process.

Software Integrations

Unlike the systems of the past, modern online donation software for nonprofits integrates with accounting and marketing applications to save time and reduce costs.

Analytics and Reporting

Most fundraising management software systems allow you to produce reports using nonprofit financial metrics most relevant to your organization.

Association Management Software

Donor management software such as DonorPerfect, NeonCRM, and Bloomerang, feature fundraising tools that track donations and manage donor data. Other systems, such as iMIS, offer comprehensive donation tracking features along with tools to raise funds, publish website content, create email campaigns, and more.

Why Successful Nonprofits Choose iMIS

iMIS is a leading association management system used by nonprofit organizations throughout the world. Nonprofits choose iMIS because it provides a wide range of features, including:

- Donor management

- Fundraising and crowdfunding campaign management

- Event management

- Email marketing

- Content management

iMIS additionally unlocks more functionality when integrated with other systems, such as memberSYNC.

iMIS gives you everything you need in one place.

iMIS is an all-in-one solution for nonprofits that provides all the features needed on a unified interface. Besides streamlining processes, iMIS helps reduce data entry, minimizes repetitive tasks, improves accuracy, and leverages the power of automation to improve productivity.

iMIS can be customized to how your team works.

Every organization is different. That’s why you need software with extensive customization options that enable you to tailor the system to the needs of your team.

iMIS allows you to create custom reports, personalize dashboards, and create unique data fields. As a result, your organization saves time, reduces costs, and can allocate resources to initiatives that increase value to stakeholders.

iMIS integrates with leading nonprofit software solutions.

iMIS integrates leading nonprofit software applications, such as Sage Intacct, TopClass, VoterVoice, and more.

Integrated software opens up new worlds of functionality, allowing data to flow between departments to enhance decision-making and improve collaboration. Everything simply works better, allowing teams to improve productivity with fewer resources.

iMIS is cloud-based software that unites employees from any connected location.

iMIS can be accessed by any credentialed user on any mobile device at any connected location. Further, the software can be easily scaled as your organization grows without the need for new licenses, upgrades, or updates.

iMIS features robust security protocols to safeguard your data.

iMIS features data encryption and role-based access controls to safeguard sensitive data and keep your files secure. Backups and disaster recovery are handled by the system, ensuring your digital assets are safe from cybersecurity threats.

iMIS offers world-class support.

iMIS is so much easier to learn and use when compared to spreadsheets and disjointed legacy software systems. Users have 24/7 access to comprehensive support and training resources, including webinars, online documentation, and online support.

The right donation management software accelerates your fundraising efforts and maximizes your impact.

Integrated, intuitive fundraising software can manage donations, members, events, financial transactions, and more - all in one place.

enSYNC has helped hundreds of nonprofits leverage technology to maximize their impact for over 25 years. Contact us to schedule a free assessment to learn more about how integrated software can transform your organization, unite your team, and ultimately power your mission.

Recent Posts

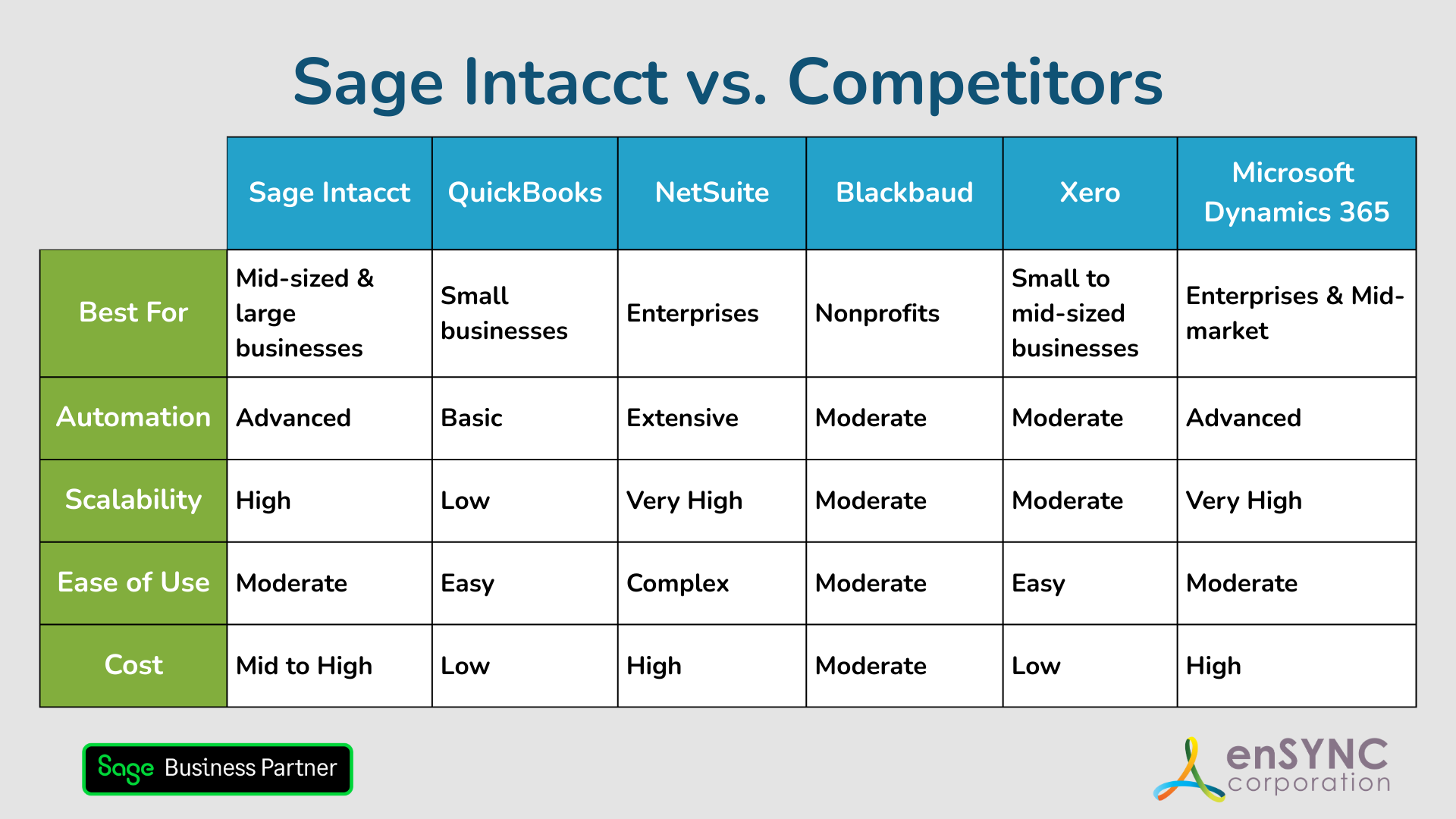

Sage Intacct vs. Competitors: Finding the Best Accounting Solution for Your Nonprofit

Choosing the right accounting software is a critical step for any organization — and a deeply personal one, too. How to choose the accounting...

How Sage Intacct Transforms Nonprofit Financial Management: A Complete Guide

Staying on top of financial management is crucial for all businesses, especially nonprofits. Nonprofits often have limited resources and handle...

Enjoying our blog?

At enSYNC, we want to empower associations and nonprofits to make well-educated decisions. If you want our industry knowledge (and other free guides) sent directly to your inbox, fill out the form below.