Technology & digital transformation | Strategy & planning | Financial associations

How to manage continuing education for finance associations

November 8, 2022

|

Online education is a growing industry, giving financial associations a unique opportunity to provide certifications, courses, and workshops that meet the needs of today’s finance professionals.

This quick guide helps you get started with strategies that help your association provide high-quality education experiences while improving back-end operations.

Short on time? Then download our Financial Association Playbook with everything included in this quick guide, plus more digital transformation strategies you can start implementing today.

Finance associations have a unique opportunity to provide critical continuing education.

Financial professionals understand that they must keep up with the latest changes in industry requirements and rules to stay qualified in their positions. In addition, they have other incentives to complete continuing education (CE) coursework, including maintaining their licenses, qualifying for promotions, moving to a different sector, or changing location.

Continuing education requirements vary by state, however most programs comprise several elements, including:

- Regulatory elements that cover rules, regulations, compliance, communication issues, and supervisory topics

- Firm elements that apply to finance professionals involved in securities sales or trading

- State-approved education for insurance professionals that agents and brokers must complete to main their license to practice in that state

- Continuing education for professional designations that include additional CE credits beyond what is needed to maintain their licensing and practice requirements

There are numerous types of organizations finance associations can serve to provide professional development educational programs, online courses, licenses, and certifications, including:

- Banks and credit unions

- Bankers associations

- Financial planning institutes

- CPA societies

- Credit and collection organizations

Besides providing online programs, associations can organize workshops, live events, and training sessions for programs requiring a practical component. And unlike a traditional college or university, financial associations are more flexible and can innovate to adapt to the growing demands of digital-first learners.

Finance associations face multiple challenges in the digital environment.

Providing CE programs presents many challenges for finance associations, especially those using disjointed legacy software that is difficult to use and maintain.

Some challenges include:

- Keeping track of members’ continuing education credit hours, credits awarded, and maximum credits allowed

- Tracking CE requirements in associated member organizations or chapters

- Connecting legacy software systems and databases such as customer relationship management (CRM) applications, membership engagement systems, payment applications, and learning management software

- Changing rules, regulations, and compliance requirements by sector and location

- Extra data entry and redundant tasks arising from disconnected software systems

- Data silos that prevent the flow of data between departments

Integrated software solutions solve legacy challenges while providing superior educational experiences.

Cloud-powered continuing education software solutions work together to help you provide exceptional learning experiences while saving your staff time and reducing costs throughout your organization.

However, a learning management system on its own usually isn’t enough to fully experience the power of integrated software. To fully understand the benefits of modern solutions, finance associations should incorporate the following three essential components into their technology stack:

1. Membership management software

Cloud-based membership management software handles multiple functions within your organization that enables you to:

- Manage member data

- Track member transactions

- Create content and publish it to your website

- Track membership engagement

- Send member communications

- Track marketing campaigns

- Manage continuing education and certification programs

- Process dues payments and perpetual membership programs

Modern membership software should also be easy to configure according to your finance association’s operations. Some features to look for when choosing such a system include:

Website Management

Look for a solution that integrates with your online content management system to fuse member management with your web presence.

Automation

Ensure your software uses automation to schedule tasks, automate emails, and send staff alerts. That way, you get more done in less time and have the energy to focus on activities that add value to your association.

Data Management

Membership management software contains unique tools to manage contacts, addresses, and demographic information for members, donors, and other stakeholders. Integration with other applications allows you to send that data to accounting, marketing, and other departments to provide complete 360-degree visibility and transparency.

Event Organization

Streamline event organization and execution with digital registrations, personalized agendas, polls and surveys, and multiple secure payment options.

Advanced Reporting & Analytics

Look for a system that generates an extensive range of reports with customized insights that enhance decision-making and provide deep insights to pivot your strategy when required.

2. Learning management system

An online learning management system (LMS) gives you the tools to provide continuing education courses, certifications, and other interactive digital learning experiences.

Look for a system that includes the following features:

- An easy-to-use, intuitive interface that simplifies content creation and course delivery

- Tools that help you easily import and organize assets in the content library

- An HTML editor to produce content with minimal coding

- Tools to share and reuse resources across different courses

- Learning paths to help students achieve their goals

- In-course features that enable instructors to provide personalized feedback via text comments, audio, and video

3. Accounting software

Traditional accounting applications and spreadsheets can be disjointed, time-consuming, and prone to human error.

Modern association accounting software solutions solve those legacy problems and simplify accounting processes through automated workflows that save time, improve collaboration, and drive productivity.

Not all software is ideal for finance associations. To get the best return on your investment, look for a system that includes the following features:

- Real-time metrics you can use to produce reports, dashboards, and visualizations

- Customized parameters that allow you to define, track and report on organizational objectives

- Easy integration with membership management, learning management, and membership payment software

- Tools that track and report on funding restrictions, program outcomes, and budget to actual results

- Ready-to-use templates tailored to finance associations

- 24/7 accessibility from any device at any connected location

Download the Financial Association Playbook for more expert continuing education insights

enSYNC is dedicated to helping financial associations succeed. Download the Financial Association Playbook to learn how digital transformation helps improve learning experiences, increase engagement, boost revenue, and grow membership numbers.

Recent Posts

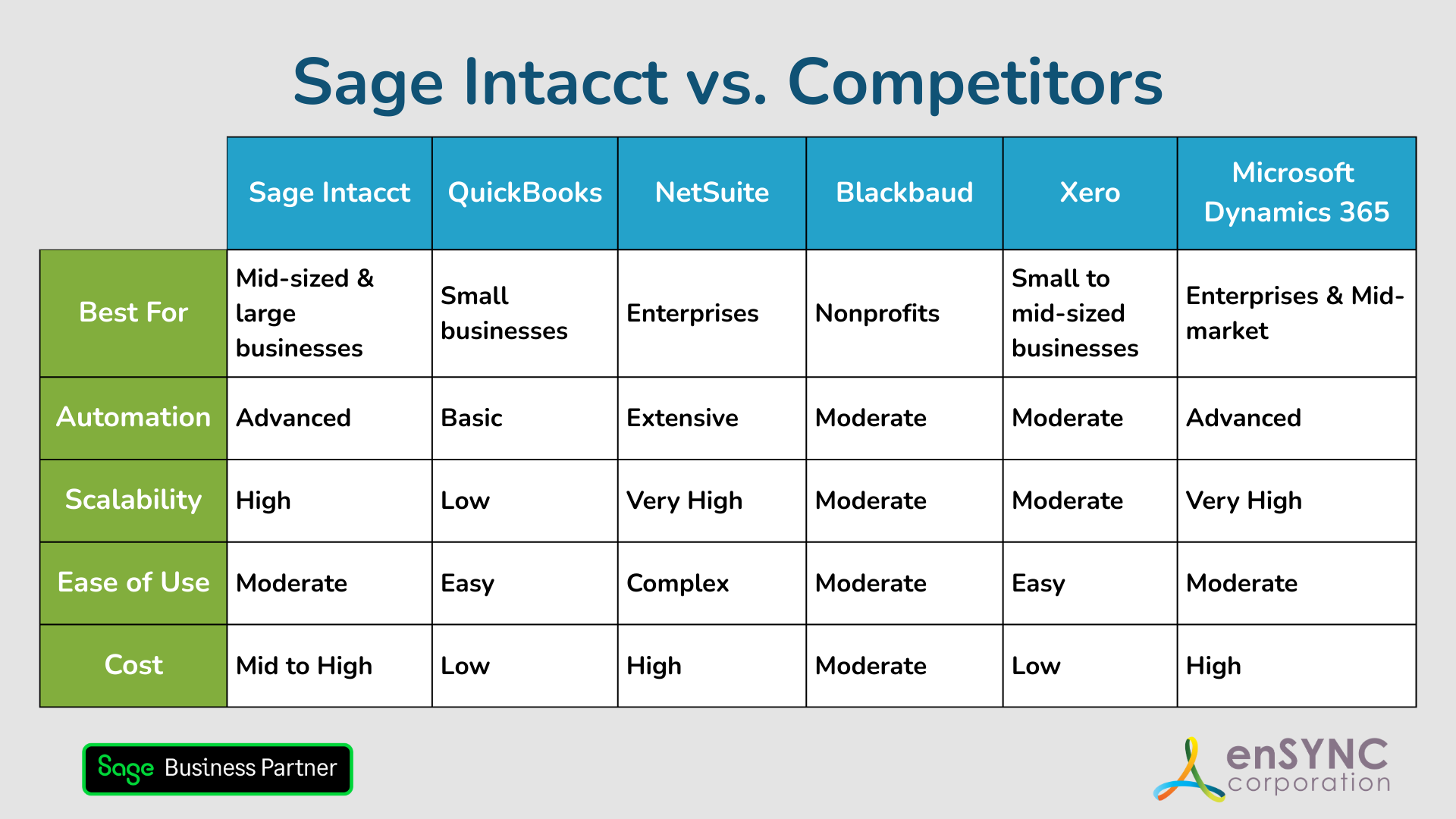

Sage Intacct vs. Competitors: Finding the Best Accounting Solution for Your Nonprofit

Choosing the right accounting software is a critical step for any organization — and a deeply personal one, too. How to choose the accounting...

How Sage Intacct Transforms Nonprofit Financial Management: A Complete Guide

Staying on top of financial management is crucial for all businesses, especially nonprofits. Nonprofits often have limited resources and handle...

Enjoying our blog?

At enSYNC, we want to empower associations and nonprofits to make well-educated decisions. If you want our industry knowledge (and other free guides) sent directly to your inbox, fill out the form below.