Webinar | Software solutions | Financial management | General orgainzations

Video: How To Use Clover (Formerly BluePay) with iMIS

April 5, 2023

|

Clover (formerly BluePay) is an easy-to-use, flexible, and secure payment processing system. Nonprofits and associations choose it because it helps them save on fees while offering many features that improve the member experience.

Join us for a webinar that outlines how payment processing works, and how to integrate BluePay (Clover) with iMIS.

Here’s what you’ll learn:

- The players in the payment processing world

- Steps involved in payment processing

- How the RefundXpress iMIS integration makes refunds easy with BluePay

Can’t watch the webinar right now? No problem! We’ve provided a quick summary below:

What is Payment Processing?

Payment processing is a set of services provided by third parties that facilitate the flow of financial transactions between sellers and buyers.

Third-party payment processing companies work together throughout the transaction process and ensure the safety and security of data across the entire ecosystem. Supported payment channels include all major credit cards, debit cards, gift cards, and ACH.

The Payment Processing Ecosystem

The payment processing ecosystem comprises five main groups:

Acquirers/Processors

Acquirers are financial institutions that process electronic payments for merchants. They typically link the merchant to a payment network such as Mastercard, American Express, and Visa. In some cases, acquirers provide processing software and hardware, and are responsible for transferring the funds to the merchant's bank account.

Processors are intermediaries between the payment network and the acquirer. They handle the routing, authorization, and transaction settlements and ensure transactions are processed securely.

Card Networks

Card networks provide the infrastructure that enables customers to pay for goods and services securely. Examples of card networks include Visa, Mastercard, Discover, UnionPay, and American Express.

Issuers

Issuers pay the acquirer for approved transactions and collect payment from cardholders. These include the cardholder’s bank, fintech companies, and payment firms. Examples include Bank of America, JPMorgan Chase, Wells Fargo, Citigroup, and Capital One

Gateways

Gateways connect a customer’s shopping cart, point of sale system, or virtual terminal to major credit and debit card networks, payment processors, and the customers' bank. Examples include PayPal, Stripe, and Authorize.net.

ISOs/MSPs

Independent Sales Organizations (ISOs) and Merchant Service Providers (MSPs) are third-party entities that act as intermediaries between the merchant and the payment processing ecosystem. They typically work with payment processors and acquirers to provide services that include:

- Payment terminal and hardware systems

- Merchant account setup and management

- Payment processing and settlement

- Value-added services such as chargeback management, fraud prevention, transaction reporting, and analytics tools

Examples of ISOs and MSPs include First Data, Elavon, and Global Payments.

What is Clover (formerly BluePay)?

Clover (formerly Bluepay) is a payment processing company that provides transaction processing solutions. These include hardware and software systems that enable businesses to process online and offline payments, manage orders, track purchases, and produce sales reports.

Clover solutions range from simple to complex systems, including point-of-sale (POS) hardware, POS software, companion applications, and virtual terminals.

How Clover Integrates with iMIS

iMIS is a cloud-based association management software customized for nonprofits and associations. It features a range of tools that enable organizations to manage membership services, events, fundraising, online content, analytics, and more.

enSYNC developed the following suite of products that integrate iMIS with Clover, including:

RefundXpress

RefundXpress is a lightweight module that processes refunds without requiring the customer’s credit card information. Instead of requiring the number, the software uses the gateway’s encrypted transaction token to reference the purchase.

enSYNC tailored RefundXpress for nonprofits and associations to enable them to process full or partial refunds for products and services that include:

- Membership Dues

- Courses

- Merchandise

- Events

Clover Express Checkout

Clover Express Checkout allows members to pay for goods and services using Clover's payment gateway page. This is similar to the Paypal option many ecommerce stores offer on the customer’s checkout page.

Clover Express Checkout is ideal for nonprofits and associations that don’t want to invest in creating an online store when they only have a few products available for sale. The module is also ideal for organizations that want a complete end-to-end solution that doesn’t subject them to a Payment Card Industry (PCI) audit.

eCheck Functionality

The eCheck function is a lightweight module that gives members the option to pay for goods and services via check. When enabled, the application appears on the RiSE cart page, allowing customers to pay via ACH by inputting their banking information.

Are Clover payment processing solutions PCI-compliant?

Absolutely! Clover implements all standards in accordance with the Payment Card Industry Security Standards Council (PCI SSC) to protect your member’s credit and debit card information.

The PCI Data Security Standards (PCI DSS) requirements include:

- Building and maintaining a secure network that includes encrypting data transmission, firewalls, and restricting access to cardholder data

- Cardholder data protection via encryption, access controls, testing security systems, and monitoring

- Maintaining a vulnerability management program

- Strong access control measures, including restricting physical access to cardholder data, two-factor authentication, and assigning unique user IDs

- Regular network testing and monitoring, including the implementation of an incident response plan, network testing, and tracking and monitoring access to cardholder data

PCI DSS standards are mandatory. Failure to comply can result in significant penalties and fines. Clover complies with all PCI DSS standards to ensure robust protection for customer data and system security.

Clover improves the payment experience while reducing fees.

Clover makes payment processing easy for nonprofits and associations by offering payment solutions that have it all: POS hardware, POS software, and a virtual terminal.

enSYNC brings it all together with specialized iMIS integrations that allow nonprofits to efficiently process transactions and refunds with first-in-class security. Besides helping organizations reduce expenses, our Clover integrations also improve customer service by offering numerous card payment options, ACH payments, and recurring billing.

Curious about how much money Clover can save your organization? Contact us for a free assessment to learn more.

Recent Posts

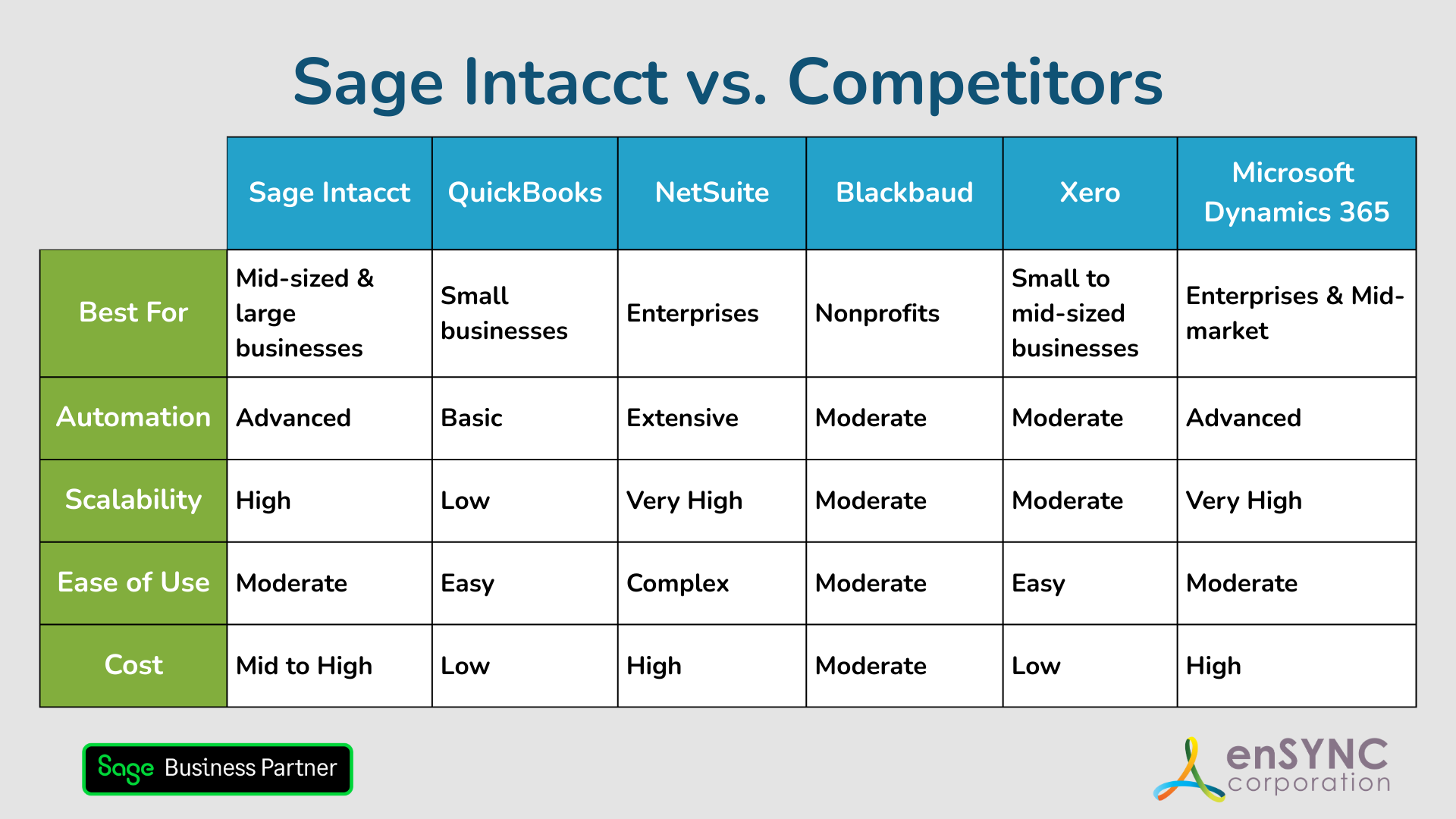

Sage Intacct vs. Competitors: Finding the Best Accounting Solution for Your Nonprofit

Choosing the right accounting software is a critical step for any organization — and a deeply personal one, too. How to choose the accounting...

How Sage Intacct Transforms Nonprofit Financial Management: A Complete Guide

Staying on top of financial management is crucial for all businesses, especially nonprofits. Nonprofits often have limited resources and handle...

Enjoying our blog?

At enSYNC, we want to empower associations and nonprofits to make well-educated decisions. If you want our industry knowledge (and other free guides) sent directly to your inbox, fill out the form below.