Nonprofits & associations | Financial management | Member engagement

Tips to Manage Membership Payments for Financial Associations

November 9, 2022

|

Offering valuable services to members is critical to growing your financial association. Providing members with easy, secure, and convenient options to pay for those services is a vital part of the equation.

This short guide outlines tips to modernize your processes and streamline payment systems. To access the complete guide, download the Financial Association Playbook to learn how to evolve your association into a data-driven organization that meets the needs of today’s professionals.

Does your outdated membership payment system result in lost renewals and sales?

Dated systems that are slow, hang, and look unprofessional reduce consumer confidence. Besides degrading the member experience, disjointed systems are challenging to maintain and cause numerous administrative problems when transactions don’t complete.

Payment systems have come a long way since the beginnings of ecommerce. Modern solutions can sync with existing software to provide an integrated experience that minimizes data entry, saves time, and streamlines processes throughout your association. As a result, members enjoy a seamless experience that inspires confidence in the association and its services.

Finance associations face multiple challenges in the digital environment.

Providing CE programs presents many challenges for finance associations, especially those using disjointed legacy software that is difficult to use and maintain.

Some challenges include:

- Keeping track of members’ continuing education credit hours, credits awarded, and maximum credits allowed

- Tracking CE requirements in associated member organizations or chapters

- Connecting legacy software systems and databases such as customer relationship management (CRM) applications, membership engagement systems, payment applications, and learning management software

- Changing rules, regulations, and compliance requirements by sector and location

- Extra data entry and redundant tasks arising from disconnected software systems

- Data silos that prevent the flow of data between departments

Types of Membership Payments

Finance associations provide a range of services, including memberships, continuing education, merchandise, and online and in-person events. As a result, payment systems should be flexible with options to collect different types of payments, including recurring payments, automatic debit, one-time payments, and installments.

Recurring payments vs. automatic debit

Recurring payments are typically linked to subscriptions, while automatic debits are paid automatically from a member’s bank account. The two are frequently confused, but the difference lies with the service being provided. For example, a credit card bill that is automatically paid from a member’s account is an automatic debit. In contrast, a streaming service is a subscription paid on a recurring basis.

Recurring payments vs. installments

Recurring payments are made according to a subscription agreement while installments are payments that split the total cost of goods or services into multiple transactions. For example, an association may charge a recurring membership fee of $100 per year. In contrast, the same organization may offer a payment plan for a $900 multi-day event that can be paid in three $300-dollar installments.

Choose a payment structure that fits into your association's revenue stream.

When choosing the right payment structure, it helps to outline the types of revenue your association receives. These can include:

- Membership dues

- Donations

- Continuing education fees

- Merchandise sales

- Event tickets

Each member-based service or product will have its own type of payment. Making your system efficient depends on choosing the suitable payment method and connecting it seamlessly to your accounting software and membership management platforms.

For example, if you have recurring membership dues, you may want to give options for monthly, semi-annual, and annual payments. These options should be reflected in your system when the member makes a payment. Likewise, if your association accepts donations, you can offer membership options to contribute on a recurring basis or pay in installments.

Seamless payment systems provide multiple benefits to finance associations and improve the member experience.

Today’s membership payment systems are easy to customize and can integrate with your current member and website management applications. You don’t have to employ a professional software programmer or know how to code to set them up.

Cloud-based payment systems save employees time and improve efficiency. They can be easily configured to offer multiple payment methods, pre authorized recurring payments, and options that allow users to pay in installments. Further, you can choose from a variety of professional-looking templates that provide a professional image and inspire confidence in your members.

Components of a Membership Payment Software Stack

To provide a seamless payment experience, financial associations need to integrate a membership management solution with an application that processes payments. Ideally, both these systems also connect to accounting software.

When used together, these cloud-based solutions work together to share member information and streamline tasks, so you save time and improve productivity. As a result, operations on the back end are optimized and running smoothly, leading to an overall improved member experience.

Membership Management Software

Cloud-based membership management software is the pillar of your software stack, providing web-based tools that enable you to:

- Effectively manage membership data

- Increase member engagement

- Track transactions

- Publish content to your website

- Engage in email marketing

- Launch marketing campaigns

- Manage continuing education and certification programs

- Process dues payments and perpetual membership programs

iMIS is the leading choice for financial associations, chambers of commerce, and nonprofits to manage members, launch fundraising campaigns, create website content, manage continuing education, and much more. Unique membership management tools help streamline processes, allowing you to do more in less time so you can focus resources on enhancing the membership experience.

Payment Processing Software

Payment processing software enables members to pay for membership dues, continuing education, and events via desktop and mobile apps. Choose a system that can process one-time payments, recurring payments, and installments with options to pay by debit card, credit card, and cheque.

enSYNC’s paymentSYNC integrates easily with iMIS to track transactions, update member profiles, and save time on your end-of-the-month reconciliation.

On top of that, you could save up to 15% on credit card processing fees.

Accounting Software

Cloud-based accounting software brings it all together for a truly seamless experience. The latest solutions simplify accounting processes through automated workflows that organize tasks and save time from data entry and other redundant tasks.

financeSYNC is the leading solution financial associations and nonprofits trust to fuse member management systems with payment processing applications. Leveraging Sage Intacct or Quickbooks Online, financSYNC enables you to

- Leverage real-time metrics to produce reports, dashboards, and visualizations

- Customize parameters that allow you to define, track and report on key objectives

- Track and report on funding restrictions, program outcomes, and budget to actual results

- Access over 150 ready-to-use templates tailored to finance associations

- Access the system 24/7 from any device at any location

Learn more payment and revenue strategies tailored to financial associations

enSYNC is dedicated to helping financial associations succeed. Download our Financial Association Playbook to learn how to grow memberships, improve services, and adapt successfully to the constantly changing technological environment.

Recent Posts

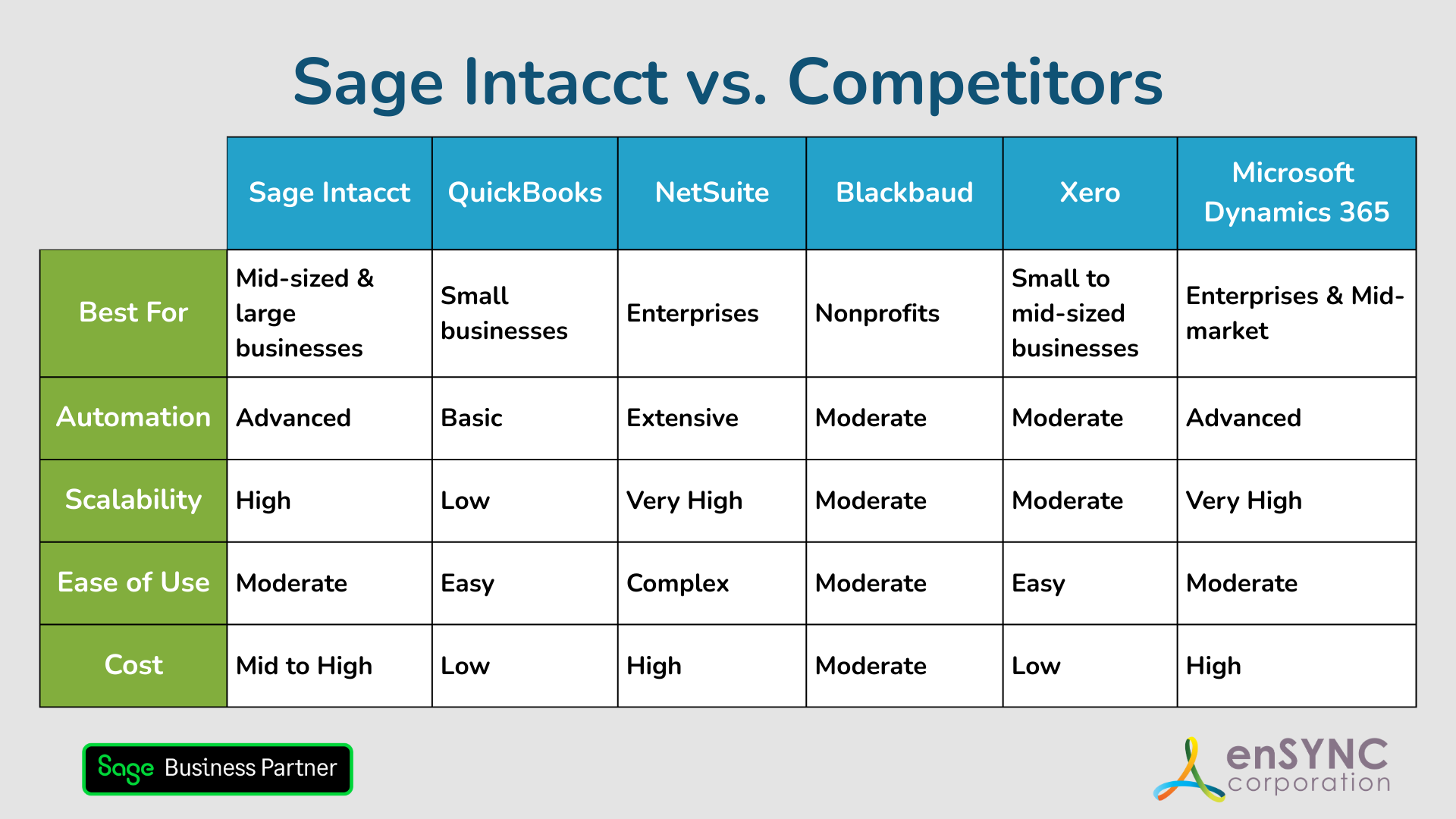

Sage Intacct vs. Competitors: Finding the Best Accounting Solution for Your Nonprofit

Choosing the right accounting software is a critical step for any organization — and a deeply personal one, too. How to choose the accounting...

How Sage Intacct Transforms Nonprofit Financial Management: A Complete Guide

Staying on top of financial management is crucial for all businesses, especially nonprofits. Nonprofits often have limited resources and handle...

Enjoying our blog?

At enSYNC, we want to empower associations and nonprofits to make well-educated decisions. If you want our industry knowledge (and other free guides) sent directly to your inbox, fill out the form below.