Nonprofits & associations | Financial management | Member engagement

16 Member Engagement Tips for Financial Services Associations

November 10, 2022

|

Engagement is the key to retaining current members, attracting a new audience, driving profitability, and improving your organization’s profile. This quick guide contains tips tailored to financial associations that help them achieve those goals.

Short on time? Then download our Financial Association Playbook with everything included in this quick guide, plus more digital transformation strategies you can start implementing today.

Has member engagement been dropping in your financial association?

Does your financial association play a significant role in the professional development of members and member organizations? Do they look to your association for education, guidance, advocacy, and networking opportunities?

If not, they may wonder if membership is valuable when it comes time for renewal.

Engaged members are proof that your financial association provides value. However, keeping members involved is difficult without the right environment and digital infrastructure to address growing challenges.

Financial associations face numerous challenges in the current environment.

The work environment continues to change as employment opportunities, transactions, networking, and training options move online. As a result, associations that aim to stay relevant must evolve in order to increase engagement and grow memberships.

Digital infrastructure that integrates membership management, advocacy, continuing education, and accounting software is critical to adapting to the changing landscape. Unfortunately, many associations operate with outdated technology that cannot compete with online communities and platforms like LinkedIn. As a result, many members engage with alternative options and do not renew because they may not see value in association membership.

Some issues are unique to the finance industry.

The financial industry's large size and diversified sectors make it especially vulnerable to current challenges. Further, the industry is rapidly changing with increasing mergers, regulatory changes, and digital-first financial firms that redefine how consumers conduct banking transactions.

The work environment is also shifting to a remote/hybrid model, making some local associations irrelevant. As a result, members may leave smaller associations to join larger ones, and others drop out entirely.

Financial associations vary significantly according to their specific industry sector. Some of the dominant association types facing challenges today include:

Banks or Bankers Associations

Bankers associations provide banks with access to training, live events, advocacy, research, and expert guidance on compliance issues. Challenges facing these organizations include outdated technology systems, communication issues, and mergers that squeeze out smaller players and reduce membership numbers.

Financial Planning Institutes & CPA Societies

Financial planning institutes and CPA societies offer their member base education, networking, and events that help them advance their careers. Current challenges facing these organizations include attracting young professionals, competition with social media platforms, and staying relevant in a digital-first work environment.

Credit Unions

Credit unions are member-owned nonprofit financial institutions that provide banking services, including bank accounts, credit cards, and mortgages. Some challenges facing credit unions include outdated technology, customer acquisition and retention, and competition from both traditional banks and digital-first financial institutions.

Association of Credit and Collection Professionals

Credit and collection associations are trade groups that represent creditors, debt collection agencies, debt buyers, and collection attorneys. As with many financial associations, these organizations face technical challenges, competition from social media platforms, and outdated digital infrastructure.

Membership engagement is critical to grow numbers and stay relevant in the digital environment.

An association is as strong as its members. With that in mind, financial associations must offer niche services that members cannot access elsewhere.

Offering specialized products and personalized experiences to current members keeps them engaged while encouraging new members to join. This is critical to providing value to members so they consistently renew their memberships and refer your organization to colleagues and other industry contacts.

16 Engagement Tactics for Financial Services Organizations

Increasing engagement is a process you must develop from the inside-out. Below are some tips to structure your strategy, organize your team, and provide engagement opportunities that boost current member involvement and attract a new audience.

1. Set SMART Goals and Define Metrics

Setting goals for each metric gives your team a clear direction. Use the SMART formula to ensure your goals are clear and realistic.

SMART goals are:

S: Specific

M: Measurable

A: Attainable

R: Realistic

T: Timely

Some SMART goals associated with the example metrics from the previous step tip include:

- Increase new memberships by 20% by March 2023

- Increase membership retention rate to 95% by December 2022

- 10 comments per social media post by January 2023

- Increase time spent on the website by 20% by March 2023

- Increase newsletter signups by 20% by May 2023

- Increase comments on website blog by 50% by September 2023

- Increase click-through-rates from social media posts by 30% by December 2023.

Each of these goals is specific enough to track progress. They are also attainable and realistic, so your team stays inspired as they work to achieve them by the specified end date.

It’s difficult to know if you’re achieving your goals without metrics or key performance indicators (KPIs). Most membership management systems provide tools to usetrack metrics and develop an engagement scoring system so so you you know you’re on trackthe right path.

Metrics are categories of quantifiable data relevant to performance across all areas of an organization.

A few examples of engagement metrics include:

- New memberships

- Membership renewals

- Number of comments/reactions on social media posts

- Time spent on website pages

- Newsletter signups

- Website comments

- Click-through-rates from social media

Most membership management systems provide tools to track metrics so you know you’re on the right path. Define metrics that best align with the type of engagement that’s most relevant to your association.

2. Develop a member engagement strategy

Create a member engagement strategy that includes your goals, KPIs, and a content plan.

A strategy keeps your team accountable and organized. Make sure to include a comprehensive content calendar with blog posts, articles, and upcoming events. Also be sure to specify dates to release content consistently so members know when to expect it.

3. Focus on onboarding

Put extra effort into onboarding members to reassure them that joining your organization was the right choice for their careers. Send them a new member kit with valuable supplies such as pens, mouse pads, magnets, or key chains. Make sure your logo stands out, and ensure the items are valuable enough that members will give them to colleagues in case they don't need them.

4. Offer various membership levels (including a free level)

Offering a free level removes all obstacles to membership and gives you the opportunity to demonstrate value to prospective leads. Additional membership levels offer flexibility and provide upsell potential to current members looking to upgrade their services.

5. Offer discounts

Everyone loves a good deal. Seek out sponsors, advertisers, and complimentary organizations to offer special discounts exclusive to members.

The finance industry is vast and diversified, giving you numerous opportunities to provide discounts for office supplies, events, courses, and other services specific to finance professionals. To boost engagement, you can also offer members additional discounts if they post on social media and generate referrals.

6. Start a scholarship program

Combine your continuing education services with a scholarship program to instantly grow enrollments. Encourage members to post their achievements and hold contests for free courses and certifications to expand engagement opportunities.

7. Upgrade your member portal

Increase traffic to your site, expand member benefits, and improve member retention by creating valuable career development and industry resources. Make everything exclusive to members while allowing them to share some content publicly to drive traffic to your site.

8. Collaborate with social media influencers

Social media is full of finance-oriented influencers with millions of followers across multiple sectors, including trading, investing, insurance, and cryptocurrency. Contact them about collaboration opportunities to advertise memberships, products, courses, and other association services.

9. Set up a feedback and survey system

The growing number of comment and review websites throughout the internet proves that people love to give their opinions and want to be heard. With that in mind, send surveys to ask how members feel about the industry, career opportunities, and the services you provide. Their valuable feedback will help you refine your content, including emails, blogs, events, and continuing education offerings.

10. Set up a member spotlight

Start a monthly or yearly contest that highlights an exceptional member. Offer prizes such as free courses, event tickets, or merchandise and provide incentives throughout the contest period to encourage people to participate.

11. Add an employment center to your portal

Provide extra value while increasing engagement with an employment center that allows online members to look for new opportunities and recruiters to find job candidates. You can also post internship and mentorship opportunities for newer members entering the job market.

12. Hold joint events with like-minded organizations

Partner with complementary industry and membership organizations to hold events that add value to your services. You can also offer discounts for new members and collaborate on social media campaigns to boost engagement and increase membership numbers.

13. Start a podcast

As legacy media and radio stations are de-emphasized in modern media consumption, podcasts are emerging as the newest sources of news, entertainment, and industry-related content. Start a podcast that includes valuable career advice, current news, interviews, and other content that members can use to stay connected to the industry.

14. Set up a weekly touchpoint

Post content on your website or social media that gives members something to look forward to each week. It might be an email every Monday morning with inspiration, an industry “wrap-up” report each Friday, or a special message from the CEO during the week. Ensure it’s valuable so members share the post or tag colleagues in the comments.

15. Set up your software system to keep track of engagement

All the tips listed above encourage some type of engagement or interaction with your members. Wouldn’t it be great to have a place to keep track of everything on a single interface?

Modern engagement management systems like iMIS help you track all your marketing activities while syncing with accounting and membership payment software to save time and improve efficiency. That way, you’ll know who is engaging with your association and what strategies work best to achieve your goals.

Get the playbook for digital strategies that make it easy to increase engagement.

enSYNC is dedicated to helping financial associations succeed. Download our Financial Association Playbook to learn critical strategies that improve engagement, increase revenue, and grow memberships.

Recent Posts

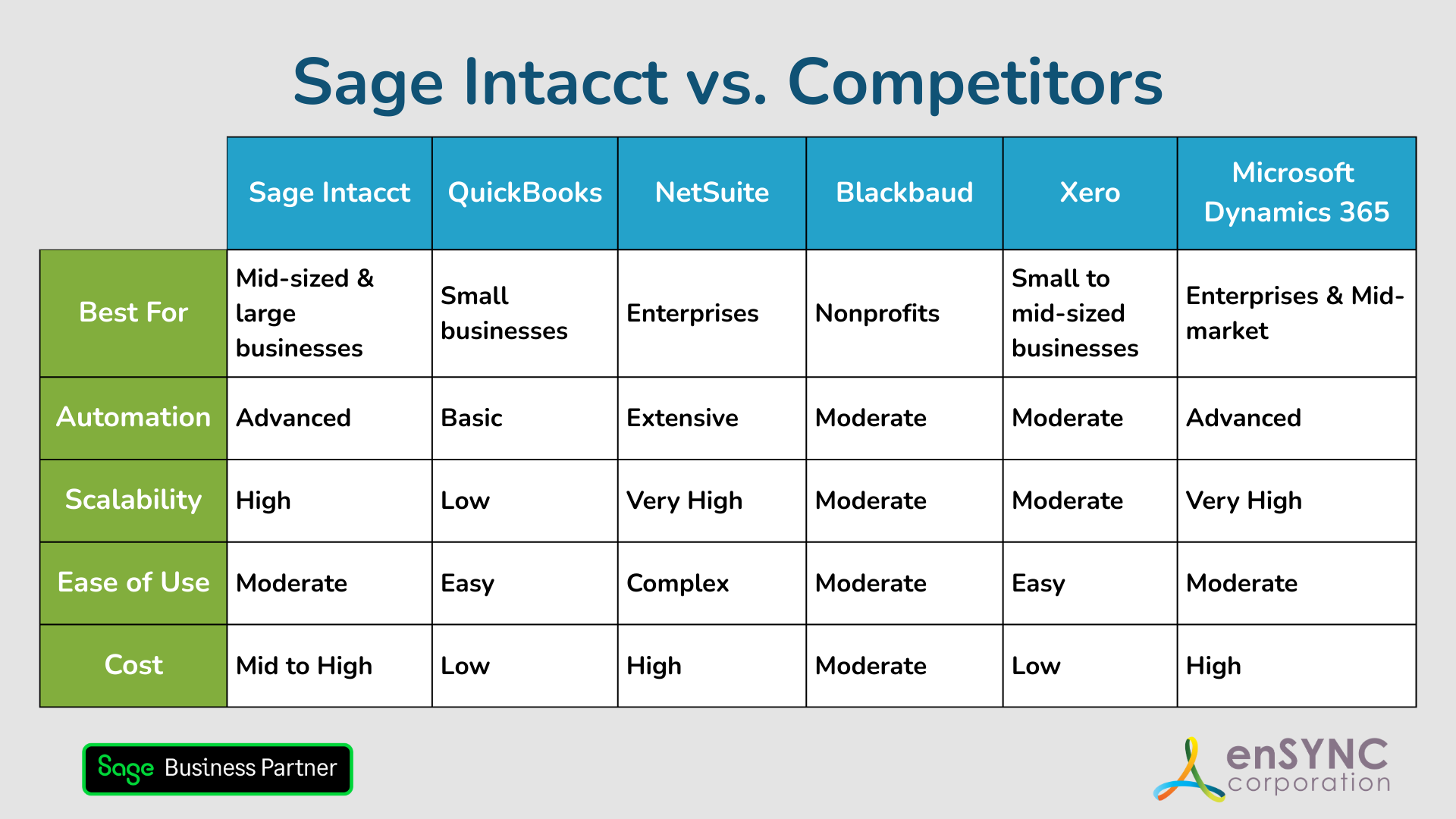

Sage Intacct vs. Competitors: Finding the Best Accounting Solution for Your Nonprofit

Choosing the right accounting software is a critical step for any organization — and a deeply personal one, too. How to choose the accounting...

How Sage Intacct Transforms Nonprofit Financial Management: A Complete Guide

Staying on top of financial management is crucial for all businesses, especially nonprofits. Nonprofits often have limited resources and handle...

Enjoying our blog?

At enSYNC, we want to empower associations and nonprofits to make well-educated decisions. If you want our industry knowledge (and other free guides) sent directly to your inbox, fill out the form below.