Software solutions | Nonprofits & associations | Financial management

Nonprofit Accounting Software That Powers Your Mission

March 17, 2021

|

Are your accounting systems powering your mission or holding it back through redundant tasks and outdated workflows?

Nonprofit finance managers understand they need to focus on the numbers. They are faced with making difficult decisions each and every day concerning the organization’s direction and where precious donor money will flow.

Technological innovation can form part of a management solution through modern accounting software that allows accounting teams to:

- Streamline their operations and improve efficiency

- Automate workflows and reduce redundant tasks

- Save time and money through improved productivity

- Produce near real-time reports with granular insights

- Increase connectivity and collaboration across departments

And much more. Changing an accounting system is an important decision that is not done often. Your choice should empower your team as it grows and evolves with your organization, allowing it to reach its maximum potential.

Technological innovation catalyzes growth

Legacy systems of the past enabled finance teams to streamline their accounts payable, accounts receivable, and financial close processes. Today’s solutions do that, and much more.

Modern software does so much more than spreadsheeting and managing donation forms.Technology has transformed how we do business, and your choice of software should empower your organization with the latest innovative features.

These include accounting, tracking, and reporting tools that perform advanced forecasting and budgeting. Challenges continue to mount, and technology can help nonprofits deal with problems in the present so they can thrive in the future.

Today’s challenges can’t be solved with yesterday’s software

Economic downturns, reduced donor flows and government budget cuts negatively affect income flows to nonprofits. These income reductions are exacerbated by an increased demand for services and growing donor expectations.

Goals need to be set and KPIs need to be measured to monitor progress.

Finding new sources of funding will always be a challenge and some nonprofits are employing new business models to keep the funds flowing. Nonprofits are also leveraging the power of marketing and branding to stand out in an increasingly competitive landscape. Goals need to be set and KPIs need to be measured to monitor progress, ideally within a comprehensive system based on solid technological infrastructure.

Nonprofit accounting software is an integral component of an overall technological solution that fuses all departments so they work together as a unified force.

Key Features of Modern Nonprofit Accounting Software

Nonprofits are unique in the business community. They require transparency across the organization and must be accountable to all stakeholders. Along with ensuring appropriate stewardship of funds, nonprofits must maintain compliance with shifting regulations.

Technology can help streamline processes so finance teams can fulfill all their financial duties while maintaining transparency and accountability. Some key features to look for when choosing an integrated accounting system to achieve these objectives include:

- A straightforward and efficient accounting framework

- Simplified basic transactions (accounts receivable, accounts payable, donor management)

- Simple, straightforward, and fast consolidations and preparation of financial statements

- Access to a wide array of report templates

- Effective management of grant requirements and fund restrictions

- Customized dashboards that feature near real-time data

- Financial reporting and statistical tracking

- Reporting and ongoing tracking of program outcomes, budget and fund restrictions

- Automated report scheduling

- Creation of dashboards and reports that combine different operating dimensions with financial data

- Flexible reporting tools that can adapt to changing compliance requirements

- 24/7 accessibility from any device

Nonprofit Accounting Software Checklist

This checklist will ensure that you are up to date on all the features available for nonprofit accounting software. Each section has its own checklist, divided up according to the following categories:

- Nonprofit/fund accounting

- Financial process automation

- Analytics/financial insights

- Cloud architecture considerations

- Available integrations

1. Nonprofit/Fund Accounting

Growing compliance regulations and a need for efficient stewardship of funds require transparency and accountability. This can be provided through system-wide tracking that gives visibility across multiple critical segments.

Nonprofits typically receive funding from numerous sources. This requires a fund accounting system that provides comprehensive fund tracking. Along with regular reporting and efficient operation processing, an accounting management tool should also produce a comprehensive audit trail.

Growing compliance regulations and a need for efficient stewardship of funds require transparency and accountability.

Some key features and tools required in such as system include:

A simplified fund accounting framework

- Simplified setup for transactions and reporting using a single, primary general ledger chart of accounts

- The ability to define, track and create reports on critical objectives for various areas of the organization such as grants, programs, funds, and locations

- Facilitated consolidations and reporting through the use of the same chart of accounts across multiple entities

- Access to a wide variety of report templates for quick and easy report creation according to FASB and government standards that include: Statement of Activities, Statement of Financial Position, and Statement of Functional Expenses

Fund restrictions and grant requirements management

- Customizable dashboards that provide near real-time financial and operational visibility by fund

- Tools to present financial information according to operating dimension

- Enhanced statistical tracking and reporting for an overall view of organizational performance

Simplified accounting for grants, funds, and donors

- Instant role-based team visibility through customizable dashboards that help create, manage and track near real-time financial data

- Simplified report creation for grantors, donors, board members, and volunteer management

- Easy tracking and reporting for program outcomes and funding restrictions

- Budget-to-actual-results reporting

- Automated scheduled reports that provide timely monitoring of spending and fund administration

Automated revenue management

- Disconnection of revenue recognition from fund invoicing schedule for increased efficiency and accuracy

- Easy management of funding across accounting periods

- Total compliance with FASB and IASB standards

2. Financial Process Automation

Modern accounting software takes a general ledger and extends its features to let you analyze, manage and present accounting information according to your preferences. Rather than limiting process flexibility, the most intuitive financial software should adapt to your structure and workflows instead of the other way around.

By allowing you to automate your financial processes, accounting software should help you increase efficiency through intuitive tools that simplify your workflow. Some of these specialized features include:

- Specific, drilled-down views of consolidating entries

- Creation of multi-level organizational hierarchies and stakeholder structures

- Choice of different workflows, period definitions, charts of accounts, and lists across multiple entities

- GAAP, IFRS & FASB regulatory and compliance reports

- Selection of templates that provide options that go all the way down to the transaction level

- Independent transaction processing using multiple ledgers (accounts receivable, accounts payable, cash management, and order management) without degrading general ledger performance or losing time when closing books or reporting on financial results and outcome measures

- Ability to keep multiple books on either a cash or accrual basis for the creation of multiple stakeholder custom reports based on different preferences

- Customized system access for team members and provision of read-only access to credentialed stakeholders (auditors, executives, board of directors, and the like)

3. Analytics/Financial Insights

Nonprofit organizations can leverage multiple benefits from in-depth insights into the organization using near real-time data.

Besides allowing managers to capitalize quickly on new opportunities, the use of real-time reports helps users quickly recognize if there is a need for timely corrective action.

From high-level summaries to underlying transactions, financial insights can provide a comprehensive view of the financial performance of the organization. This can be accomplished through multiple operating dimensions that let users:

- Categorize each transaction by program, donor, location, and grant

- Create dashboards and reports that can automatically combine financial data with operating dimensions for comprehensive results analysis

- Customize financial and operational data according to unique operational preferences without modifying chart of accounts or using external reporting tools

- Create self-service reports and custom dashboards that reduce ad-hoc stakeholder reporting while still providing drill-down capabilities and near real-time updates for critical insights and analytics into financial performance

- Produce a statistical book of measures that includes funding, impact, constituents, and locations not captured in the standard ledger to provide granular insight into success metrics found within the accounting system

- Leverage flexible, customizable reporting tools that allow accounting teams to easily and quickly manage changing compliance requirements

- Balance cash outflows and inflows through tools that help avoid overspending and ensure that budgets are followed

4. Cloud Architecture Considerations

Cloud-based integrated accounting systems help nonprofit organizations leverage the most innovative technology while lowering IT costs, reducing hardware costs, lowering technology risks, and improving productivity.

Software deployed on the cloud also gives organizations the flexibility to choose the solutions best suited to their unique needs, according to their top priorities. This allows for external integrations between departments through application programming interfaces that unite parts of the organization and reduce redundant tasks associated with separated workflows.

Cloud-based accounting software provides significant advantages that include:

- Easy scalability and increased performance as the organization grows

- Dramatically-lowered overall costs through reduced hardware expenses and IT costs for training, upgrades, and support

- Increased connectivity and collaboration across all departments and users through self-service reports and customized dashboards

- Near real-time updates with drill-down capabilities for granular insights

- Regular automatic system updates that ensure all software is current and up to standard

- “Always on” and accessible 24/7 from any mobile device and operating system with an internet connection

Key considerations when choosing a cloud provider

Not all cloud vendors are equal. If you choose a cloud-based accounting software provider, it is essential to evaluate the vendor’s reputation and track record of success. Some key factors to consider when selecting a cloud provider should include:

- Successful track record of integrations across different types and sizes of organizations

- World-class data safety and security

- Full ownership of your data, including a comprehensive agreement to migrate data in the event you choose to end the relationship

- Access to expert support staff through an ongoing support agreement

- A top-tier service agreement with the proven infrastructure to back it up

Moving your accounting to the cloud means that your financial system is effectively being run by the software provider rather than your internal IT department. This makes your assessment of cloud vendors absolutely critical when choosing cloud-based software.

5. Easy integration with other systems

Businesses on today’s digital landscape use a variety of applications across their departments. Modern accounting software should provide convenient integrations that are easy to implement without any complex coding or IT skills. Whether it’s software that helps manage donors or organize fundraising campaigns, integrations are critical to streamlining the activities of an organization.

Modern accounting software should provide convenient integrations that are easy to implement without any complex coding or IT skills.

Some typical applications include:

- Customer relationship management system (CRM)

- Fundraising software/peer to peer fundraising applications

- Email marketing applications/newsletter publication

- Event management/fundraiser event software

- Donor/donation management

- Online donation processing software

- Credit card processing applications

- Social media management software

- Human resources software

- Inventory management

- Project and program management

- Payment processing

- Payroll software

- Automated Clearing House (ACH) processing

The right software provider is a partner in your success

Investing in a new accounting software system is not a frequent event. Along with assessing all requirements and priorities, the process should also include researching and vetting software providers. This ensures that you are working with a partner that is committed to providing you with a first-in-class system that will grow with your organization. Some key points to consider when choosing a company include:

- Focus on accounting systems

- Experience with nonprofits

- Track record of successful integrations

- Organization and financial commitment to upgrade their in-house systems

- Industry recognition and awards

- Top ratings and reviews from trusted third-party sources like TrustRadius and G2 Crowd

A Final Word

enSYNC’s financeSYNC integrated nonprofit software is powered by Sage Intacct - an industry leader in cloud financial management. With a successful track record of bringing cloud computing power to accounting, Sage Intacct’s innovative and award-winning applications are recognized across the industry.

enSYNC’s solutions are designed to help nonprofits improve their performance and increase productivity through world-class integrated systems that streamline processes, automate workflows, increase connectivity and facilitate collaboration. From startups to large nonprofit groups, financeSYNC can help unite your organization towards achieving stellar financial performance that will power your mission.

Recent Posts

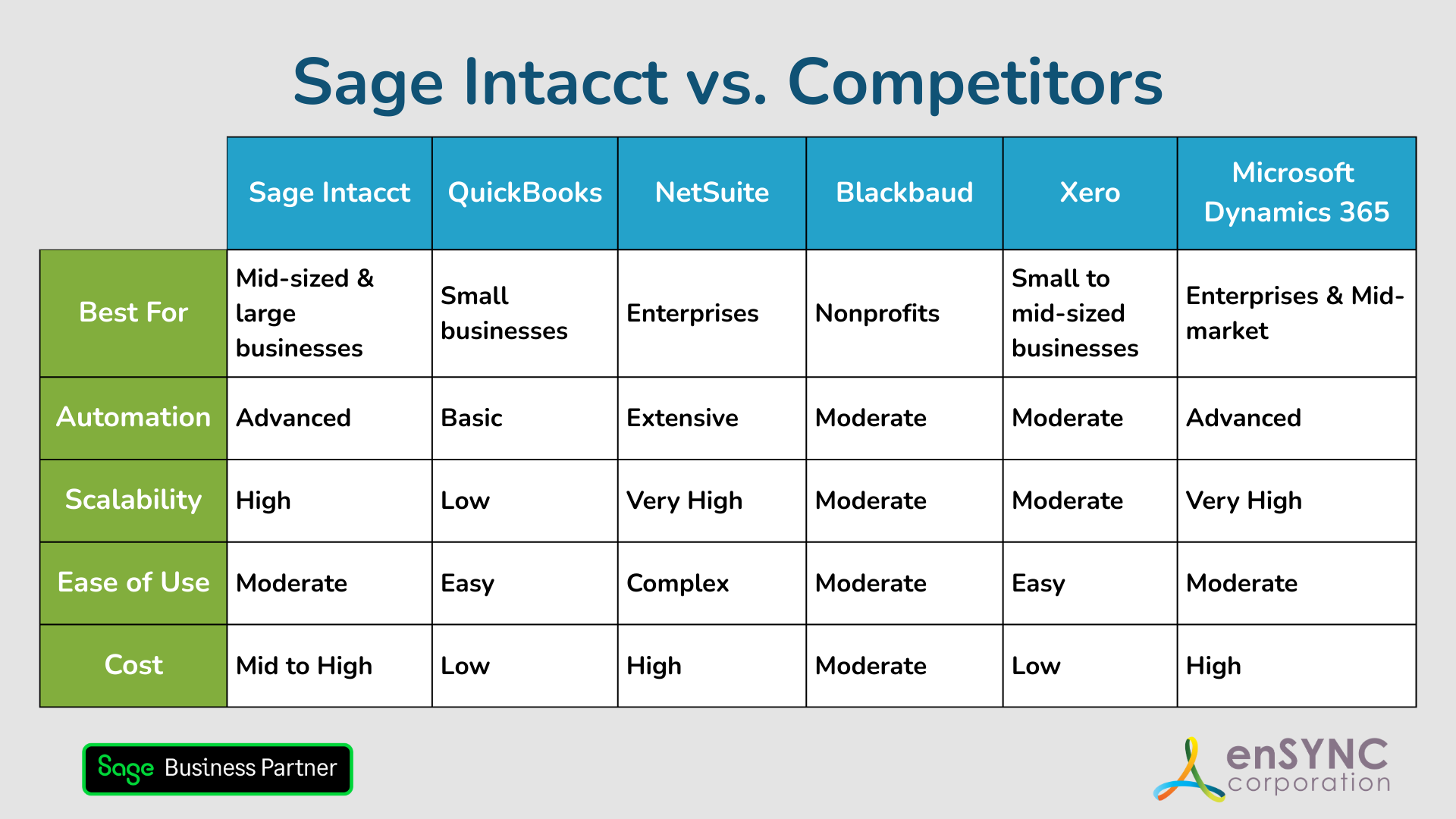

Sage Intacct vs. Competitors: Finding the Best Accounting Solution for Your Nonprofit

Choosing the right accounting software is a critical step for any organization — and a deeply personal one, too. How to choose the accounting...

How Sage Intacct Transforms Nonprofit Financial Management: A Complete Guide

Staying on top of financial management is crucial for all businesses, especially nonprofits. Nonprofits often have limited resources and handle...

Enjoying our blog?

At enSYNC, we want to empower associations and nonprofits to make well-educated decisions. If you want our industry knowledge (and other free guides) sent directly to your inbox, fill out the form below.