Financial management | Compliance & security | Nonprofits

The Easy Guide to Nonprofit Revenue Recognition

March 10, 2021

|

Revenue recognition standards change over time, and the unique nature of nonprofits requires special attention to rules that are continually evolving according to the changing business landscape.

When it comes to revenue recognition standards, nonprofit organizations are primarily concerned with two standards: one that covers contributions and another covering exchange transactions.

Recent changes by the Financial Accounting Standards Board (FASB) have now provided a new framework for revenue recognition that affects how these transactions are recorded and revenue is recognized. This easy guide will help familiarize you with those changes to make the necessary adjustments needed and prevent any unwelcome surprises in the event of an audit.

Problems with Nonprofit Revenue Recognition

The typical way most nonprofit organizations recognize revenue is to:

- Record income as cash

- Invoice customers and donors and record that income as accounts receivable

One issue with that method is that creating an invoice does not necessarily mean that the revenue is recognized correctly. An invoice is simply a request to get paid, and while creating an invoice can result in the proper recognition of income, there are times when it goes nowhere because it doesn’t get paid.

That’s why some accountants prefer to record all income as cash when it is received, however, this is inconsistent with different types of transactions received by nonprofits. Understanding new rules is one of the barriers that must be overcome in order to clean up the books and produce accurate financial statements ahead of a potential audit.

Important Revenue Recognition Terms

Let’s first clarify some terms before diving into new revenue recognition rules:

Contributions

Contributions include all donations, gifts, and grants. To qualify, they must be nonreciprocal, whereby the donor does not receive anything of value. Contributions must also be wholly voluntary and unconditional - unless it’s a matching grant. In that case, the income is recognized once the matching funds are raised.

Exchange Transactions

Exchange transactions occur when each party voluntarily gives and receives something of approximately equal value. An example that can apply to a nonprofit would be a price-discounted meal in exchange for a reduced price for individuals with a relatively low income. Even if the nonprofit receives a below-market price for the service, it is still considered revenue and is recorded as an exchange transaction.

Combo Transactions

Transactions falling into a grey area between exchange transactions and contributions are called combo transactions. An example would be a special event or raffle where part of the ticket’s cost pays for the good or service, and part is a contribution to the organization. The way revenue is recognized in this case is to assign part of the ticket as a contribution and the other part as an exchange transaction.

Agency Transactions

An agency transaction is when the nonprofit receives funds restricted by a donor for a specific beneficiary. An example could be a fundraising drive that collects medical expense money for an individual undergoing treatment.

Revenue Recognition Challenges

According to Generally Accepted Accounting Principles (GAAP), receiving cash may not necessarily imply that income was received. Applying the rules correctly in that case may then result in a significant change in financial statements that may pose huge problems during an audit.

This is especially true for exchange transactions. Nonprofits faced some challenges regarding exchange transactions after FASB released the Accounting Standards Update (ASU) 2014-09 in 2014. Accountants at different organizations interpreted the rules in different ways, resulting in inconsistent reporting across organizations.

FASB Provides Framework Through New ASUs

FASB released ASU 2018-08, which provided a new framework that allowed accountants to clearly determine whether a transaction should be accounted for as a contribution or exchange transaction. ASU 2018-08 also provided criteria for determining if a contribution was conditional with implications on the transaction’s timing and when it could be recognized as revenue.

New FASB Standards for Revenue Recognition

Finding out how to correctly record and recognize revenue depends on new rules laid out by the FASB in the following ASUs:

- Accounting Standards Codification (ASC) Topic 606 that includes ASU 2014-09: Revenue from Contracts with Customers (plus several ASUs that followed)

- ASC Topic 958-605 that includes ASU 2018-08: Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made

These updates have profound implications for nonprofit revenue recognition and are effective for the 2019 fiscal year and all calendar year audits moving forward.

Nonprofit Revenue Recognition Steps

Nonprofit revenue according to the new rules can be recognized and recorded using the following steps:

- Rule out agency transactions

- Determine if the funds are a contribution or exchange transaction

- Apply appropriate procedure in accordance with Step 2

Step 1: Rule out agency transactions

The first step is to determine if the money coming into the organization is an agency transaction. If so, record the funds as a liability on the balance sheet until they are paid out.

If the transaction is not an agency transaction, proceed with Step 2.

Step 2: Determine if the transaction is a contribution or exchange transaction

If the transaction is not an agency transaction, then use the following set of questions to determine if it is a contribution or exchange transaction:

A. Are there service fees?

If fees were charged for the organization’s service, then the revenue is considered an exchange. This includes contracts for deliverables or other specific services.

B. Is the transaction a membership fee? Does it include any extra services or other benefits?

Fees charged for memberships that include benefits such as publications, special events, or education are classified as exchange transactions. If membership dues are partly a contribution, then they can be divided between both types of transactions.

C. Is it a government grant? If so, is it tied to a specific person?

Government grants are classified as contributions if they are charitable with benefits to the general public. Examples include grants that provide goods and services to children or senior citizens. Payments from government agencies, however, are classified as exchange transactions when connected to specific services such as Pell grants or Medicaid services tied to specific people.

Government grants are classified as contributions if they are charitable with benefits to the general public.

Government grants or programs that result in work where ownership rights go to the government are exchange transactions. Conversely, if funding for a program, such as university research, allows the school to retain ownership rights, the grant can be recorded as a contribution.

Contributions vs. Exchange Transactions

The American Institute of Certified Public Accountants (AICPA) provides the following chart that summarizes attributes that differentiate contributions and exchange transactions:

|

Contribution |

Exchange Transaction |

|

Not-for-profit (NFP) states that it is soliciting a contribution |

NFP asserts that it is seeking resources in exchange for specified benefits |

|

Resource provider asserts that it is making a contribution to support the NFP’s programs |

Resource provider asserts that it is transferring resources in exchange for specified benefits. |

|

Delivery method is at the discretion of the NFP |

Delivery method is specified by the resource provider |

|

Resource provider determines the amount of the payment |

Payment by the resource provider equals the value of the assets to be provided by the recipient NFP of the asset's costs plus markup |

|

NFP is not penalized for nonperformance |

NFP is penalized for nonperformance |

|

Assets are to be delivered to individuals or organizations other than the resource provider |

Assets are to be delivered to the resource provider or to individuals and organizations closely connected to the resource provider |

|

Source: AICPA Not-For-Profit Entities - Audit and Accounting Guide |

|

Step 3: Apply appropriate contribution or exchange transaction procedure

A. Contribution Transactions

If the transaction is a contribution, the following steps can be taken:

- Determine if it is conditional or unconditional

If the donation is conditional, the contribution can be recorded once the condition is satisfied - Determine if the contribution is restricted or unrestricted

If gifts are restricted to a specific time or purpose, then different recording procedures need to be applied

There are many aspects to accounting for restricted gifts that go beyond the scope of this article. More information can be found on the website of The National Council for Nonprofits.

B. Exchange Transactions

If the transaction is not a contribution, it falls under exchange revenue. Common sources of exchange revenue according to FASB include:

- Tuition & fees

- Exchange grants

- Membership dues

- Sponsorship revenue

- Royalty/licensing revenue

- Program fees

Rental income, leases, insurance reimbursements, guarantees, and nonmonetary exchanges are NOT included.

Exchange transactions are subject to the following steps:

- Identify the contract(s) with a customer

- Identify the performance obligations in the contract

- Determine the transaction price

- Allocate the transaction price to the performance obligations in the contract

- Recognize revenue when (or as) the entity satisfies a performance obligation

Wrapping Up

Revenue recognition for nonprofits is now subjected to new standards through updates by FASB that include ASU 2014-09 - Revenue from Contracts with Customers, and ASU 2018-08 - Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made.

Nonprofits now have a comprehensive framework moving forward that gives clear guidance for recording contributions and revenue. Besides taking the stress out of a potential audit, these new procedures can help managers better understand nonprofit businesses along with how tax authorities assess the activities of the organization.

Recent Posts

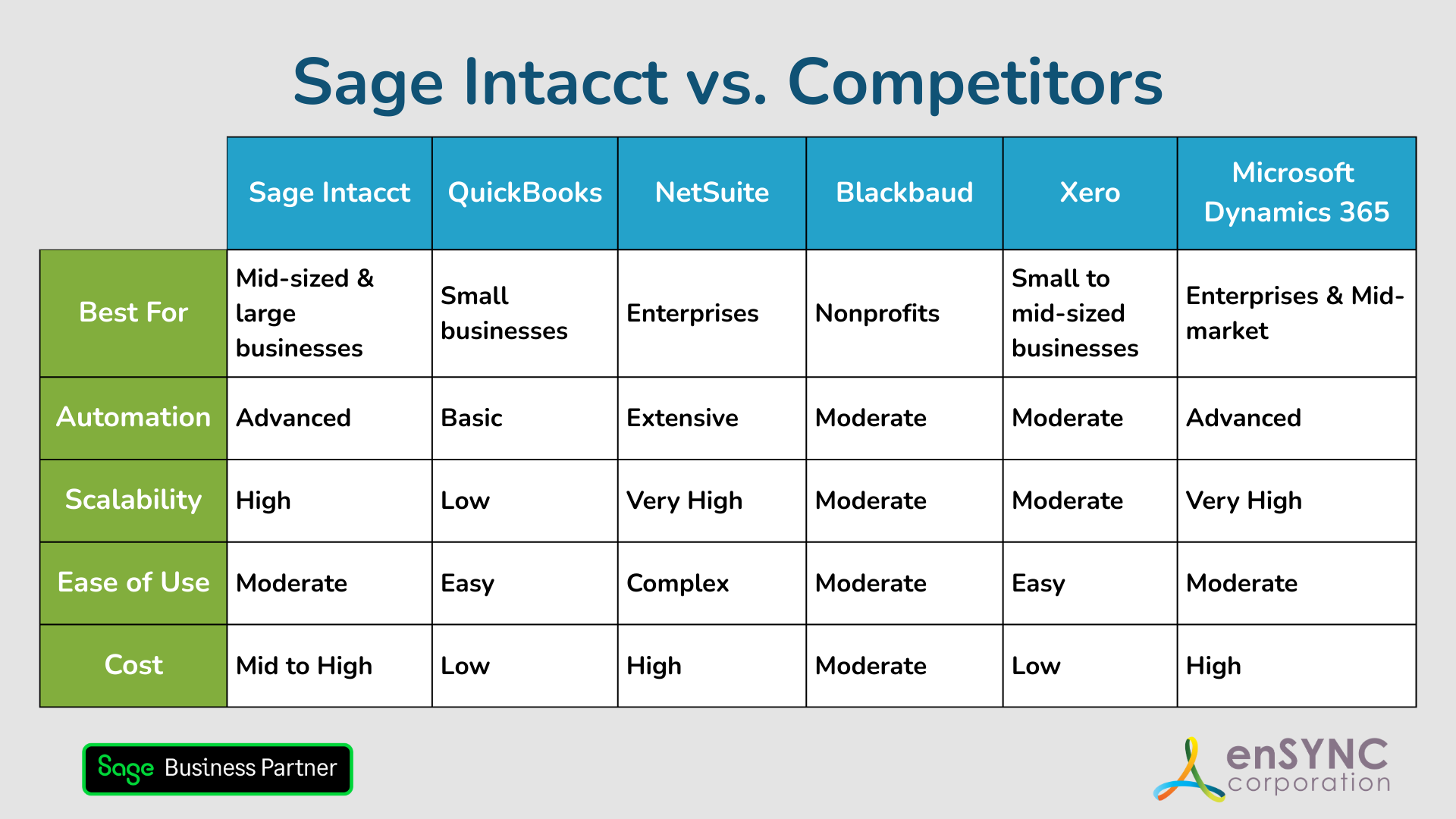

Sage Intacct vs. Competitors: Finding the Best Accounting Solution for Your Nonprofit

Choosing the right accounting software is a critical step for any organization — and a deeply personal one, too. How to choose the accounting...

How Sage Intacct Transforms Nonprofit Financial Management: A Complete Guide

Staying on top of financial management is crucial for all businesses, especially nonprofits. Nonprofits often have limited resources and handle...

Enjoying our blog?

At enSYNC, we want to empower associations and nonprofits to make well-educated decisions. If you want our industry knowledge (and other free guides) sent directly to your inbox, fill out the form below.

.png?width=755&height=200&name=Copy%20of%20enSYNC%20-%20Blog%20CTA%20-%20Buying%20Guide%20Association%20Management%20System%20for%20Legal%20Organizations%20(1).png)

.png?width=755&height=200&name=Copy%20of%20enSYNC%20-%20Blog%20CTA%20-%20Buying%20Guide%20Association%20Management%20System%20for%20Legal%20Organizations%20(3).png)