Software solutions | Senior living | Financial management

Picking the Right Accounting Software for Nonprofits

August 7, 2024

|

Picking the Right Accounting Software for Nonprofits: Your Guide to the Red (and Green!) Flags

Choosing the right accounting software for nonprofits is crucial for financial managers and administrators leading nonprofit organizations. The right tool can streamline your financial processes, ensure compliance, and provide valuable insights for better decision-making.

However, with so many options available, making the right choice can be daunting, so here is a list of pros and cons — green and red flags — that can help you evaluate if an accounting software solution is right for your nonprofit organization.

Why Accounting Software Matters for Nonprofits

Nonprofits operate under unique financial constraints and regulatory requirements. Efficient accounting software can help you manage donations, grants, and expenditures while ensuring compliance with financial regulations. It can also provide real-time metrics and personalized dashboards to track your organization's performance. Let’s look at one popular accounting software for nonprofits, Sage Intacct cloud-based accounting software, to see how it stacks up.

Green Flags That Point to a Good Accounting Software for Nonprofits

When evaluating solutions, keep an eye out for these features, which will help you meet your organization’s goals and objectives:

- Real-time Metrics Tracking. You can track real-time metrics, ensuring constant updates on your organization's performance. This enables timely decision-making and quick responses to emerging issues. (Sage Intacct: ✅)

- Personalized Dashboards and Reports. The platform lets you personalize dashboards and reports to fit your specific needs. Customize your view to see the most relevant data at a glance. (Sage Intacct: ✅)

- Automated Financial Processes. Tools and features allow you to automate your financial processes from start to finish. This automation reduces manual errors, saves time, and ensures consistency across your organization. (Sage Intacct: ✅)

- Instant Insights for Data-Driven Decisions. The software allows for immediate, real-time insights into your financial data so you can be confident in making data-driven decisions that can positively impact your organization. (Sage Intacct: ✅)

- Seamless HIPAA Compliance. Meeting HIPAA compliance regulations is crucial in the nonprofit healthcare space. The right tool will simplify this process, ensuring your organization complies with all necessary regulations. (Sage Intacct: ✅)

- Streamlined Operations Across Locations. Ensure consistency and streamline operations across multiple locations. This feature is particularly beneficial for larger organizations with several locations. (Sage Intacct: ✅)

- Convenient Tech Support. Educational resources and tech support are easily available to avoid troubleshooting on your own. (Sage Intacct: ✅)

Red Flags to Avoid When Researching Your Options

Just as there are features to look for, there are also red flags to be wary of. The benefit of Sage Intacct is that it avoids all these red flags below:

- 🚩 Lack of Real-Time Updates. Software that doesn't offer real-time metrics can leave you making decisions based on outdated information.

- 🚩 Limited Customization Options. If the software doesn't allow for personalized dashboards and reports, it may not meet your specific needs.

- 🚩 Manual Processes. Software that requires extensive manual input is prone to errors and inefficiencies.

- 🚩 Non-compliance Issues. Not all software is designed to meet specific regulatory requirements, such as HIPAA compliance. Make sure the software you choose can handle these needs.

- 🚩 Costly or Intermittent Tech Support. Surcharges for tech support make operations budgets unpredictable.

- 🚩 High Price Tag. An off-the-shelf, “one-size-fits-all” software product may not fit your organization’s needs as a nonprofit.

Choosing the right accounting software for your nonprofit organization is a critical decision that can significantly impact your operations and overall success. The benefits of Sage Intacct are clear: it is tailored to the needs of nonprofits and healthcare, including real-time metrics tracking, personalized dashboards, automated financial processes, and HIPAA compliance.

Ready to Streamline Your Financial Operations? We Can Help!

If you're ready to streamline your financial operations and make data-driven decisions, consider Sage Intacct. To learn more about how Sage Intacct can benefit your nonprofit, contact us today and get started on the path to better financial management.

Meet Josh Kozinski, the Director of Business Development at enSYNC. With expertise in Sage Intacct, iMIS, and supporting technologies, Josh's mission is to simplify complex processes by transforming rogue spreadsheets and databases into streamlined, automated solutions. His dedication to delivering strategic solutions aligns perfectly with enSYNC's commitment to efficient and innovative nonprofit management. Josh is not just a leader at enSYNC; he's actively involved in prominent industry organizations. By staying connected with these networks, Josh remains at the forefront of industry trends and best practices. In addition to his professional pursuits, Josh serves on the Board of Directors for the Dallas Fort Worth Association Executives, giving back to the industry he's passionate about. Away from the office, Josh is an athlete at heart. He pursued his college education at Central Michigan, where he played basketball. However, what Josh values most is his relationships with his family and his faith in God. Josh is always open to discussions, whether you're seeking innovative solutions for nonprofit management, exploring industry trends, or simply connecting with like-minded professionals.

Recent Posts

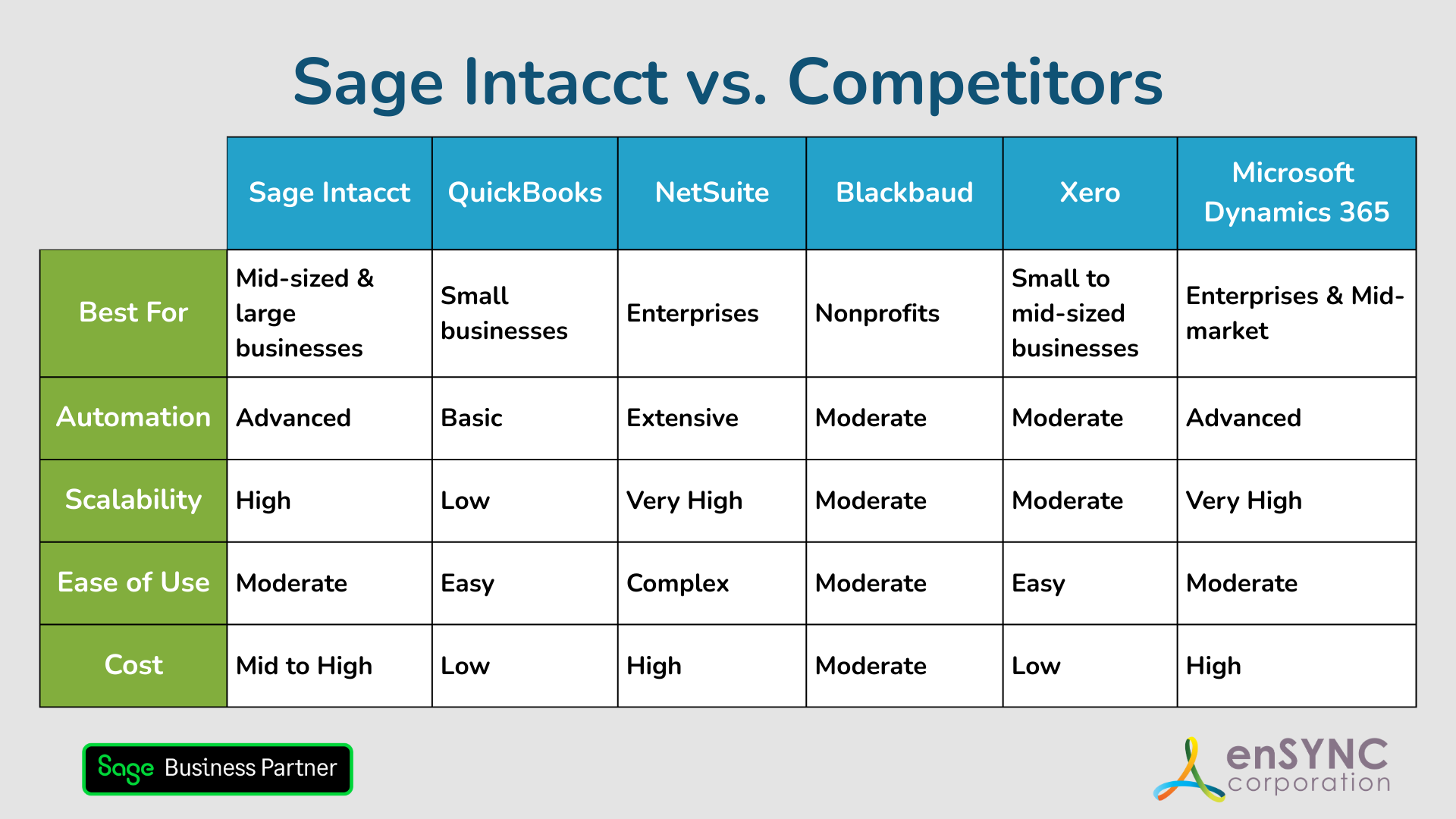

Sage Intacct vs. Competitors: Finding the Best Accounting Solution for Your Nonprofit

Choosing the right accounting software is a critical step for any organization — and a deeply personal one, too. How to choose the accounting...

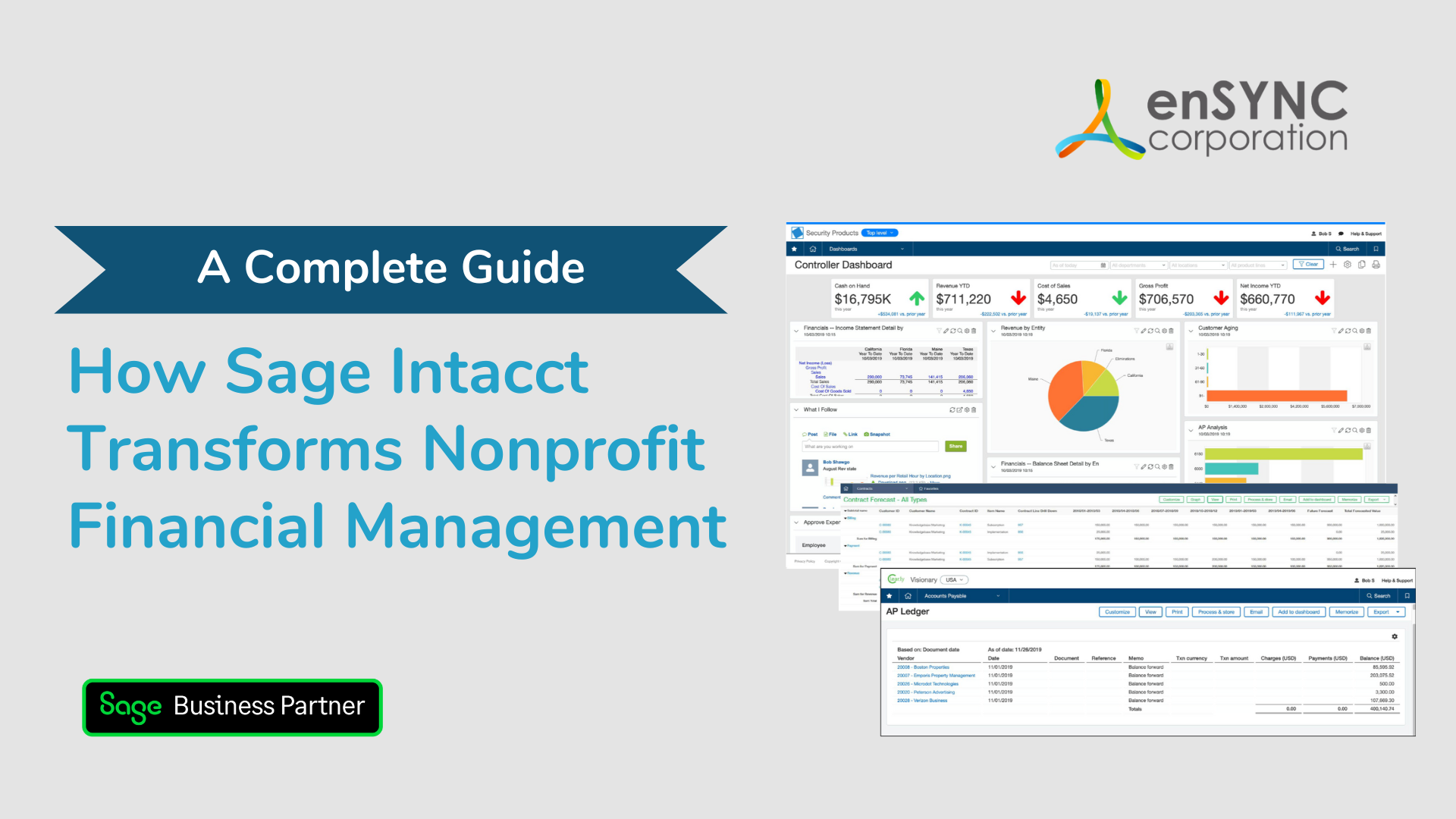

How Sage Intacct Transforms Nonprofit Financial Management: A Complete Guide

Staying on top of financial management is crucial for all businesses, especially nonprofits. Nonprofits often have limited resources and handle...

Enjoying our blog?

At enSYNC, we want to empower associations and nonprofits to make well-educated decisions. If you want our industry knowledge (and other free guides) sent directly to your inbox, fill out the form below.