Software solutions | Financial management | Nonprofits

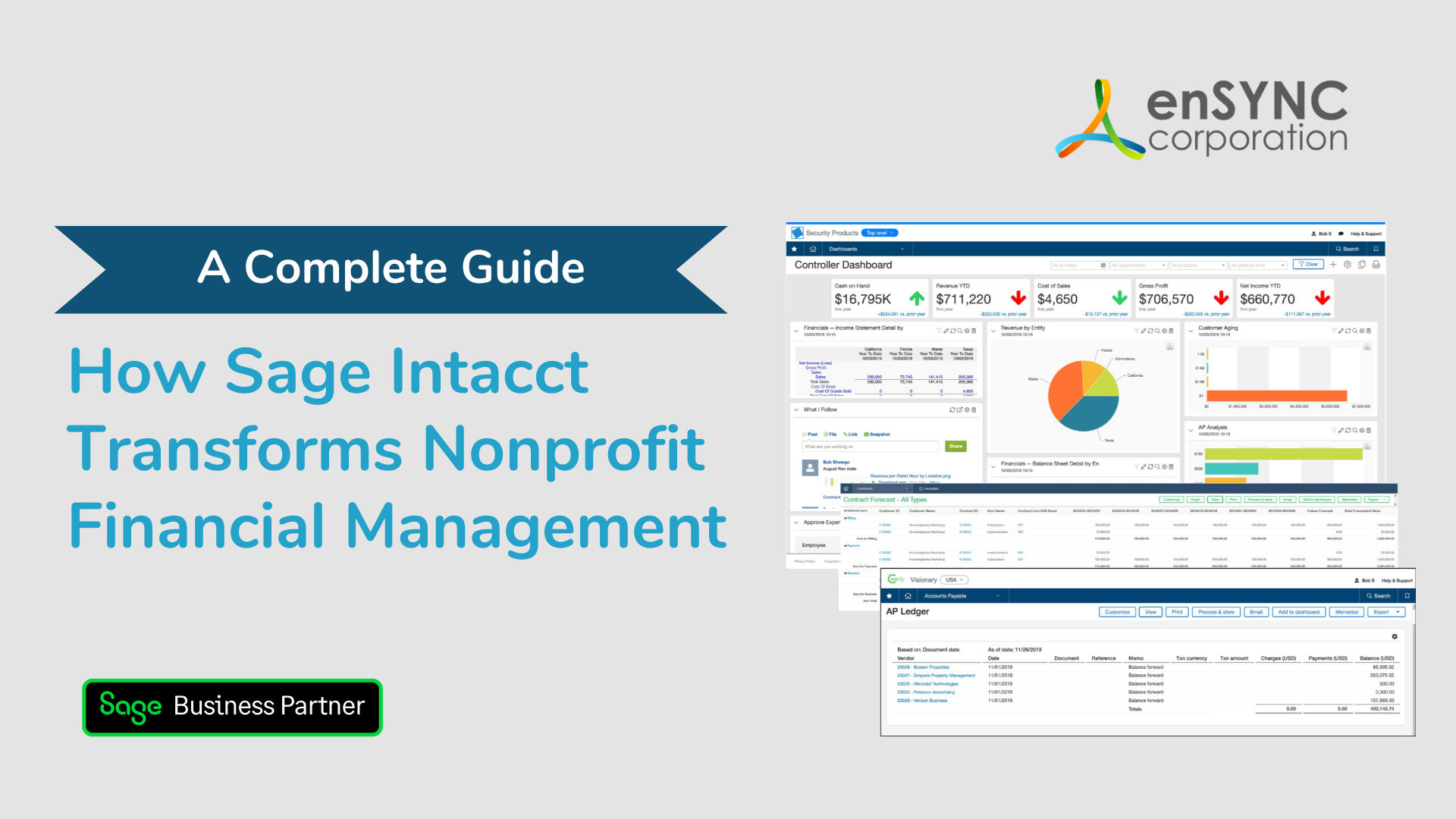

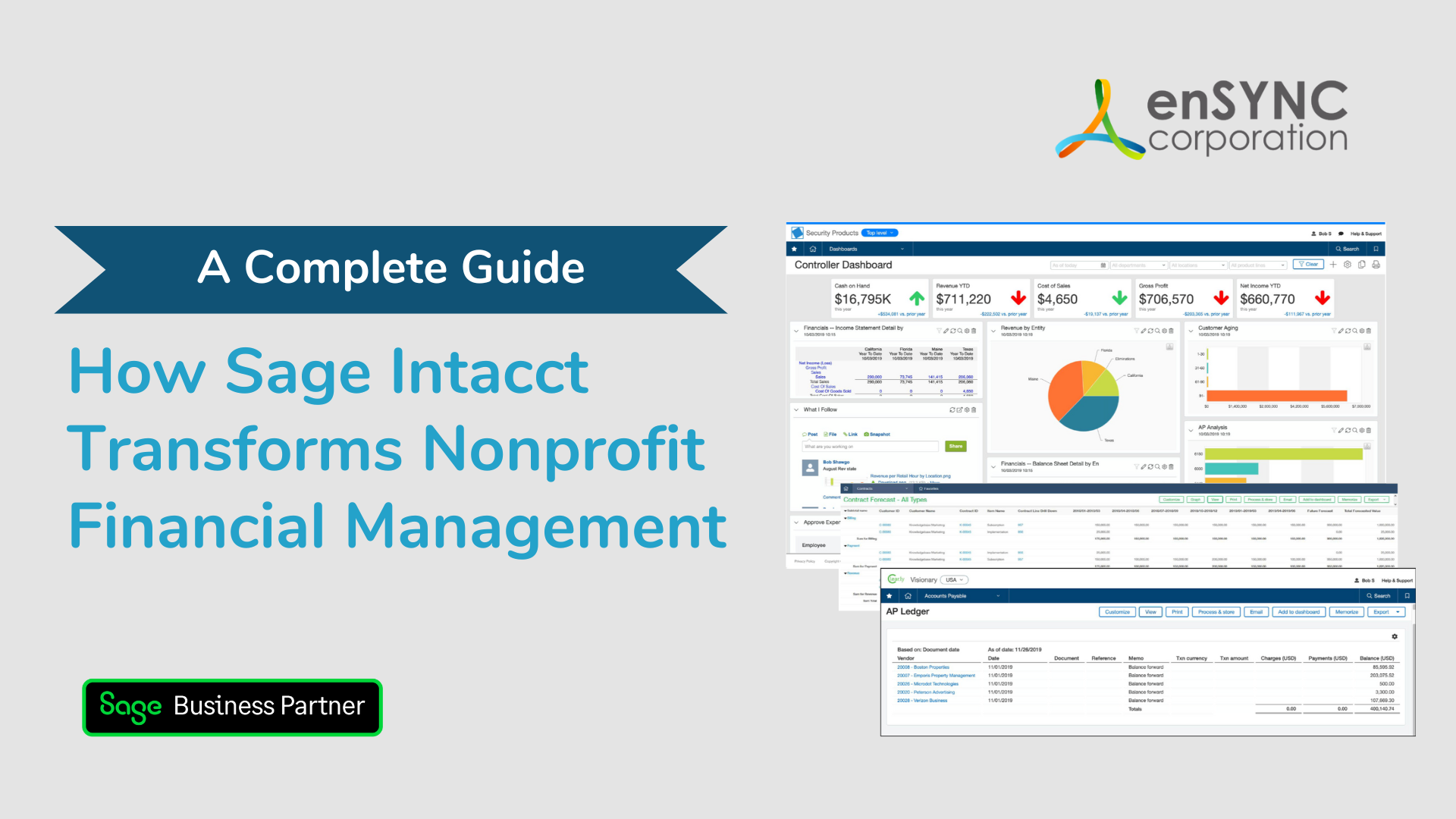

How Sage Intacct Transforms Nonprofit Financial Management: A Complete Guide

April 8, 2025

|

Staying on top of financial management is crucial for all businesses, especially nonprofits. Nonprofits often have limited resources and handle multiple funding streams, particularly from grants and donors. Because of this, nonprofits need to ensure accurate allocation and reporting to comply with specific regulations — all while managing their teams, operations, and mission.

Implementing technology to strengthen financial sustainability has consistently been a top priority for nonprofit leaders. In Sage’s 2024 Nonprofit Technology Trends Survey, 85% of respondents reported using technology for financial management and accounting — marking the third consecutive year it topped the list. Digging deeper, the survey also revealed that automating financial reporting was the number one functionality nonprofits were prioritizing in their technology investments.

That’s to say using cloud-based accounting software can be (and already is) a game-changer for nonprofits. Automated workflows and approvals enhance operational efficiency, allowing teams to focus more on mission-driven tasks rather than administrative ones.

Because of its customizable solutions, Sage Intacct is one of our top-recommended nonprofit accounting software solutions. It offers a specialized suite of features specifically designed to address the challenges that nonprofits face, regardless of size or industry.

In this guide, we discuss what Sage Intacct is, its key features for nonprofits, how it compares to other accounting software solutions, and how to implement it in your organization. We also highlight a couple of nonprofits that are benefiting from Sage Intacct in their day-to-day and long-term processes.

Find the Sage Intacct Info You Need! Jump to a Specific Section

Click below to explore a particular Sage Intacct topic:

- Understanding Nonprofit Financial Challenges

- What is Sage Intacct?

- Key Features of Sage Intacct for Nonprofits

- Improve Operational Efficiency with Sage Intacct

- Sage Intacct Case Studies

- How to Implement Sage Intacct

Understanding the Financial Challenges Nonprofits Face

“Over the years, I’ve worked with nonprofits of all sizes and missions — from newly formed grassroots organizations to long-established national associations,” says Janet Davidson, President of enSYNC. “Their goals might differ, but the financial challenges they face are remarkably similar. What’s often overlooked, though, is how significantly the right technology can help overcome these obstacles.”

These challenges are rooted in the unique financial structure and regulatory requirements that set nonprofits apart from traditional businesses.

Multiple Funding Streams

Unlike for-profit businesses, nonprofits are funded through donations, grants, and fundraising efforts, which can result in financial instability. Applying for and tracking grants can also be an onerous and time-consuming process, especially if each grant has different application requirements.

Strict Nonprofit Accounting and Tax Regulations

Additionally, nonprofits are exempt from paying taxes, so they are held to strict accounting requirements. They must comply with regulations and standards set primarily by the IRS and the Financial Accounting Standards Board (FASB). To do this, nonprofits need to file four statements every year:

- Statement of financial position

- Statement of activities

- Statement of cash flow

- Statement of functional expenses

Most nonprofits share these statements to be transparent with their donors, often including them in their annual reports. Financial statements also give donors a better understanding of how the organization is doing. Effective financial reporting and oversight can help nonprofits show their commitment to their mission by demonstrating how funds are used to achieve their goals, but organizing and tracking these reports can be a heavy lift, especially for smaller teams.

These stipulations are just a few reasons why nonprofit financial management can be complicated, which is why a cloud accounting software solution like Sage Intacct is beneficial.

What Is Sage Intacct?

Sage Intacct is a cloud-based accounting and enterprise resource planning (ERP) solution that helps businesses manage their finances — including accounting, fundraising, and invoicing — as well as other daily operations, such as payroll and human resources. Sage Intacct can be customized to fit a nonprofit organization’s unique needs with features like:

- Fund accounting

- Grant tracking and billing

- Revenue recognition

- Automated outcomes reporting

Sage Intacct was designed to streamline financial management for growing organizations, so scalability and integration with other services is built into the software.

Sage Intacct Pricing and Investment for Nonprofits

The cost of Sage Intacct varies based on the specific modules and services selected. There are annual subscription plans that include certain modules and implementation options based on Sage’s experience working with nonprofits and their needs — a standard plan for small to mid-sized organizations and a premium plan for larger, more complex organizations — as well as separate modules and upgrades. For example, as of FY25, the Sage Intacct Grants Tracking and Billing module costs $8,880.

Pricing may vary based on specific needs and configurations, so it's recommended to consult with a team like ours for pricing information.

Key Features of Sage Intacct for Nonprofits

Sage Intacct is one of our recommended accounting systems because it offers a comprehensive platform tailored to meet the unique needs of nonprofit organizations. From enhanced financial visibility with nonprofit dashboards to efficient grant and donation management, Sage Intacct empowers nonprofit organizations to focus on what matters most: making a positive impact. Below are some key features of Sage Intacct and its various modules that are specific to nonprofits.

Sage Intacct Nonprofit Features Quicklist

Click a feature to learn more!

- Fund accounting and grant management

- Automated compliance and financial reporting

- Easy budgeting and forecasting

- Donation and revenue recognition

- Easy scaling and integration with other nonprofit tools for growth longterm

Fund Accounting & Grant Management

Fund accounting is crucial for nonprofits, ensuring funds are allocated and spent according to donor restrictions and organizational policies. The Sage Intacct Fundraising module can simplify fund accounting by:

- Automating the tracking of restricted and unrestricted funds.

- Providing transparency in the allocation of resources and expenses.

Sage Intacct can also help ensure an organization is compliant with grant tracking and billing requirements. The software offers a centralized dashboard and automated grant tracking and billing that can improve the delivery, reimbursement, reporting, and audit of grant awards. This results in a faster and more accurate reporting process. With Sage Intacct, you can also:

- Centralize all grant documents and details for secure, comprehensive views, regardless of award type or funding source.

- Search and report on grant delivery, financial data, and impact metrics.

- Monitor spending and track the budget plan as the grant is used.

- Stay on top of deadlines and easily collaborate with other team members to deliver on conditions and milestones.

- Track funding details and tie deliverables to tasks.

- Get a clear audit trail for qualified expenses by designating expenses as reimbursable during transaction entry.

By streamlining fund accounting and grant tracking, nonprofits can maintain donor trust and ensure their finances align with their mission and goals.

Automated Financial Reporting & Compliance with 150 Built-in Reports

Sage Intacct provides 150 built-in financial reports and the ability to create custom reports that align with your financial, performance, and compliance goals. With Sage Intacct, you can:

- Compare financial metrics with operational statistics to enable strategic decisions that help improve internal efficiency, program effectiveness, and financial objectives.

- Drill down to source transactions for instant transparency and identify trends and anomalies with powerful visualizations that communicate the data according to your specifications.

- Simplify financial and regulatory reporting, ensuring compliance with the regulations your organization must follow.

- Deliver accurate, timely information to grantors to meet compliance requirements quickly and efficiently.

Bonus Feature: Generating Reports Is Easy and Automated

Creating a custom report is easy, as a step-by-step guide takes users through the entire report creation process. You can also automate reports, filtering delivery by department or location (including the cloud), choosing a start and end date for reporting, and choosing the timeframes that reports should be delivered, such as weekly, monthly, or yearly.

Budgeting and Forecasting with Sage Intacct Planning

Sage Intacct Planning module eliminates spreadsheet budgeting and is natively integrated with Sage Intacct Core Financials or can be easily synced with your financial data and dimensions from any ERP. Nonprofits can make better, faster, more informed decisions for growth with tools like:

- Planning

- Budgeting

- Forecasting

- What-if scenario modeling

- Reporting

- Data visualization

Sage Intacct Planning is also collaborative; budgets can be shared with multiple users across your organization so they can see data in real time.

Donation and Revenue Recognition

Donor relations are at the heart of every nonprofit. The donation management features offered by Sage Intacct help you maximize contributions and maintain strong relationships with your donors by:

- Offering seamless integration with popular donor management systems.

- Automating the acknowledgment and receipt process.

- Reporting that breaks down your donations by giving level, campaign type, or other criteria.

- Flowing fundraising data into financials in Sage Intacct to get a complete financial picture.

- Automating reimbursement requests and bills for funding sources.

- Providing insights into donor behavior and preferences.

- Customizing and personalizing donor communications.

With automated revenue recognition, you can also save time, reduce errors, and ensure compliance because everything is centralized in one place rather than in multiple external spreadsheets that require manual calculations.

Scaling and Integration with Other Nonprofit Tools

Nonprofits often face growth and changing requirements. “One of the biggest challenges we see is nonprofit organizations quickly outgrowing their financial systems,” says Josh Kozinski, Director of Business Development at enSYNC. “Many start with entry-level tools that can’t scale or integrate as they grow, leading to what we call ‘technology debt’ — a backlog of limitations that slows down operations and makes it harder to adapt. That’s why building a system to support sustained growth at any stage is essential.”

Sage Intacct for nonprofits offers scalability and flexibility to meet evolving needs. Key benefits include:

- Easy integration with other cloud applications, enhancing operational efficiency.

- Scalable solutions to accommodate organizational growth and changes in financial management.

- Customizable modules to fit the specific needs of your organization.

Scalable and flexible accounting solutions ensure your nonprofit can adapt to new challenges and opportunities without disruption.

How Sage Intacct Improves Operational Efficiency

Customization, automation, and scalability are important factors in operational efficiency. Sage Intacct and its multiple modules allow nonprofits to introduce these benefits to their teams and streamline and simplify processes.

Sage Intacct is cloud-based, which means you can access information anytime, anywhere. This helps keep everyone informed and involved and cuts down on decision-making delays.

Case Studies: Nonprofits Succeeding with Sage Intacct

Many nonprofit organizations are utilizing and benefiting from Sage Intacct. Here are a couple of examples.

Seattle Indian Health Board Boosted Revenue by 80%

The Seattle Indian Health Board (SIHB) is a nonprofit that provides healthcare and social services to urban American Indians and Alaskan Natives in the greater Seattle area.

SIHB serves more than 10,000 people annually, and relies heavily on grants from federal, state, county, and city government agencies to fund its growing operations. Managing these grants and other information was hindered by an outdated legacy accounting application, but after SIHB implemented Sage Intacct, the organization saw myriad benefits:

- Quarterly reports generated in 40 minutes instead of up to three days.

- Monthly close cycle decreased from two months to three weeks.

- Boosted revenue by 80%.

- Finance team productivity increased by 50%, with an across-the-board efficiency gain of more than 25%.

Sage Intacct’s scalability, real-time insights, and dynamic financial dashboards have supported SIHB’s growth and will continue to do so in the future. SIHB plans to roll out Sage Intacct Budgeting and Planning to improve the current manual budgeting process.

Bay County Medical Care Facility Improved Reporting Accuracy by 70%

The Bay County Medical Care Facility (BCMCF) is a nonprofit in Essexville, Michigan, that provides 24-hour skilled nursing care, including rehabilitation and restorative nursing services, memory care, Alzheimer’s care, and hospice care.

BCMCF experienced challenges with outsourced accounting services, legacy back-office systems, and Excel spreadsheets and needed a more efficient financial management solution, so they switched to Sage Intacct. Since then, they’ve seen:

- Increased team productivity by at least 50% with automated and more streamlined processes.

- Monthly close cycle decreased from three weeks to one to two days

- A 5% to 7% reduction in spending through improved visibility and accountability.

- A 50% gross margin improvement.

- A 70% improvement in reporting accuracy.

- A reduction in overtime by 35%, resulting in an overall 3% to 4% reduction in labor costs.

Sage Intacct’s specialized dashboards help make budgeting and planning easier, resulting in more financially sound and accountable nonprofit organizations.

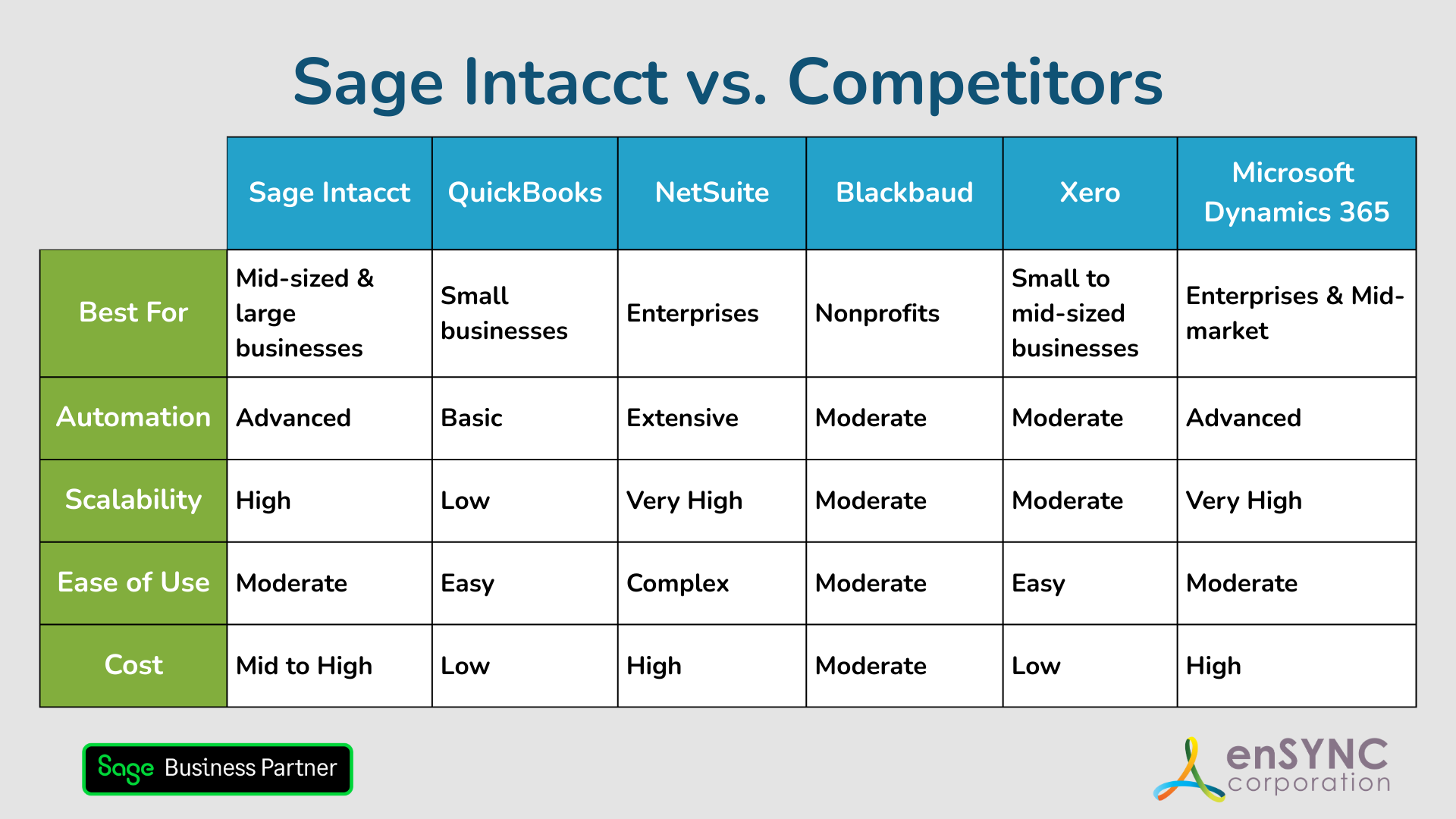

Comparing Sage Intacct to Other Nonprofit Accounting Solutions

There are myriad other nonprofit accounting software solutions out there, including Xero, QuickBooks, NetSuite, and other more traditional accounting software. Here is how they stack up to Sage Intacct:

- Scalability: Sage Intacct grows alongside your business, supporting increasing financial complexity. Other solutions struggle to keep up with scaling organizations.

- Automation: Sage Intacct automates many key processes, while other platforms offer automation for basic tasks but often lack the depth needed for more complex operations.

- Customization and reporting: Sage Intacct allows users to generate comprehensive, real-time reports tailored to their needs. Other solutions offer fewer or more limited customization and reporting options and can be less user-friendly.

- Financial management: Sage Intacct excels in handling complex financial workflows and focuses almost exclusively on accounting and finance, delivering deep functionality in areas like revenue recognition. Other solutions lack the same level of financial specialization and are better suited for simple financial setups.

- Limitations: Sage Intacct supports unlimited users and integrates seamlessly with a wide array of systems, while other platforms have limited integration options and may restrict the number of users per plan. Sage Intacct is also cloud-based, while traditional solutions require on-premises infrastructure.

- Cost: Sage Intacct offers a cost-effective solution for organizations seeking advanced financial capabilities without unnecessary ERP features. Other solutions may be more expensive or have hidden costs.

How to Implement Sage Intacct at Your Nonprofit

Because Sage Intacct is a comprehensive system, we recommend contacting our team to discuss your needs, deadlines, and other implementation details. You can also schedule a free, personalized Sage Intacct demo with us for more information.

By partnering with enSYNC, you get:

- Personalized strategy, configuration, and optimization of your system.

- Defined roadmap for implementation guided by a Sage Intacct expert.

- Secure data migration.

- Partner-led training and user adoption support.

- Post-implementation support.

With the help of integration consultants and product experts, you can implement Sage Intacct smoothly and successfully, no matter the size or complexity of your operations.

A Streamlined Financial Future

Sage Intacct is a cloud-based financial management solution that offers flexibility, scalability, and cost-effectiveness for modern nonprofit organizations. Its tailored features enhance transparency and efficiency, making it a valuable tool for nonprofit leaders seeking to improve their financial management strategy.

Meet Josh Kozinski, the Director of Business Development at enSYNC. With expertise in Sage Intacct, iMIS, and supporting technologies, Josh's mission is to simplify complex processes by transforming rogue spreadsheets and databases into streamlined, automated solutions. His dedication to delivering strategic solutions aligns perfectly with enSYNC's commitment to efficient and innovative nonprofit management. Josh is not just a leader at enSYNC; he's actively involved in prominent industry organizations. By staying connected with these networks, Josh remains at the forefront of industry trends and best practices. In addition to his professional pursuits, Josh serves on the Board of Directors for the Dallas Fort Worth Association Executives, giving back to the industry he's passionate about. Away from the office, Josh is an athlete at heart. He pursued his college education at Central Michigan, where he played basketball. However, what Josh values most is his relationships with his family and his faith in God. Josh is always open to discussions, whether you're seeking innovative solutions for nonprofit management, exploring industry trends, or simply connecting with like-minded professionals.

Recent Posts

Sage Intacct vs. Competitors: Finding the Best Accounting Solution for Your Nonprofit

Choosing the right accounting software is a critical step for any organization — and a deeply personal one, too. How to choose the accounting...

How Sage Intacct Transforms Nonprofit Financial Management: A Complete Guide

Staying on top of financial management is crucial for all businesses, especially nonprofits. Nonprofits often have limited resources and handle...

Enjoying our blog?

At enSYNC, we want to empower associations and nonprofits to make well-educated decisions. If you want our industry knowledge (and other free guides) sent directly to your inbox, fill out the form below.