Strategy & planning | Software solutions | Nonprofits

Sage Intacct vs. Competitors: Finding the Best Accounting Solution for Your Nonprofit

April 9, 2025

|

Choosing the right accounting software is a critical step for any organization — and a deeply personal one, too. How to choose the accounting software that’s best suited to your needs will depend on your industry, organization size, internal technical know-how (and staff ability to learn technical matters), and more. In short, you probably need a solution that’s not one-size-fits-all.

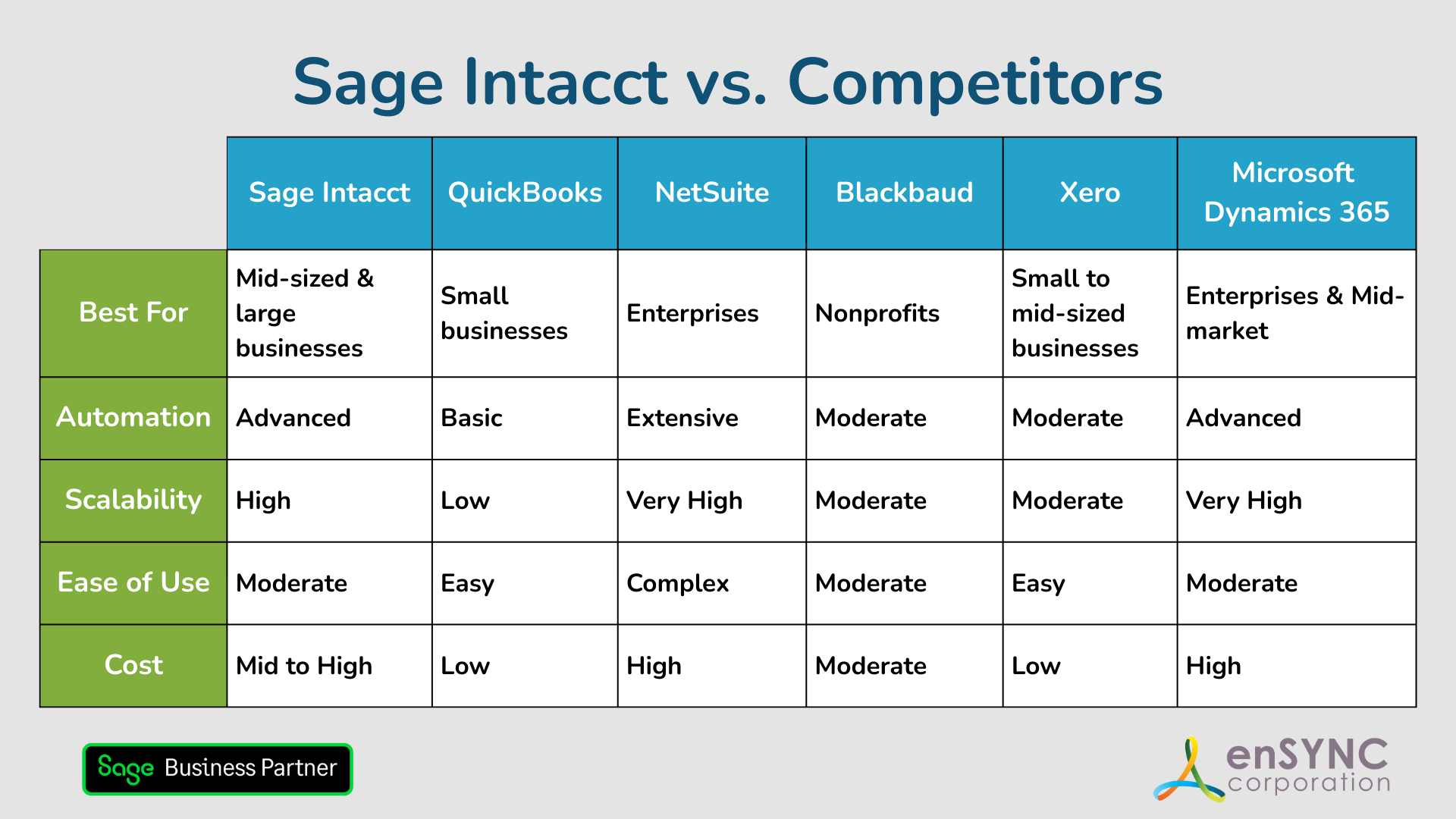

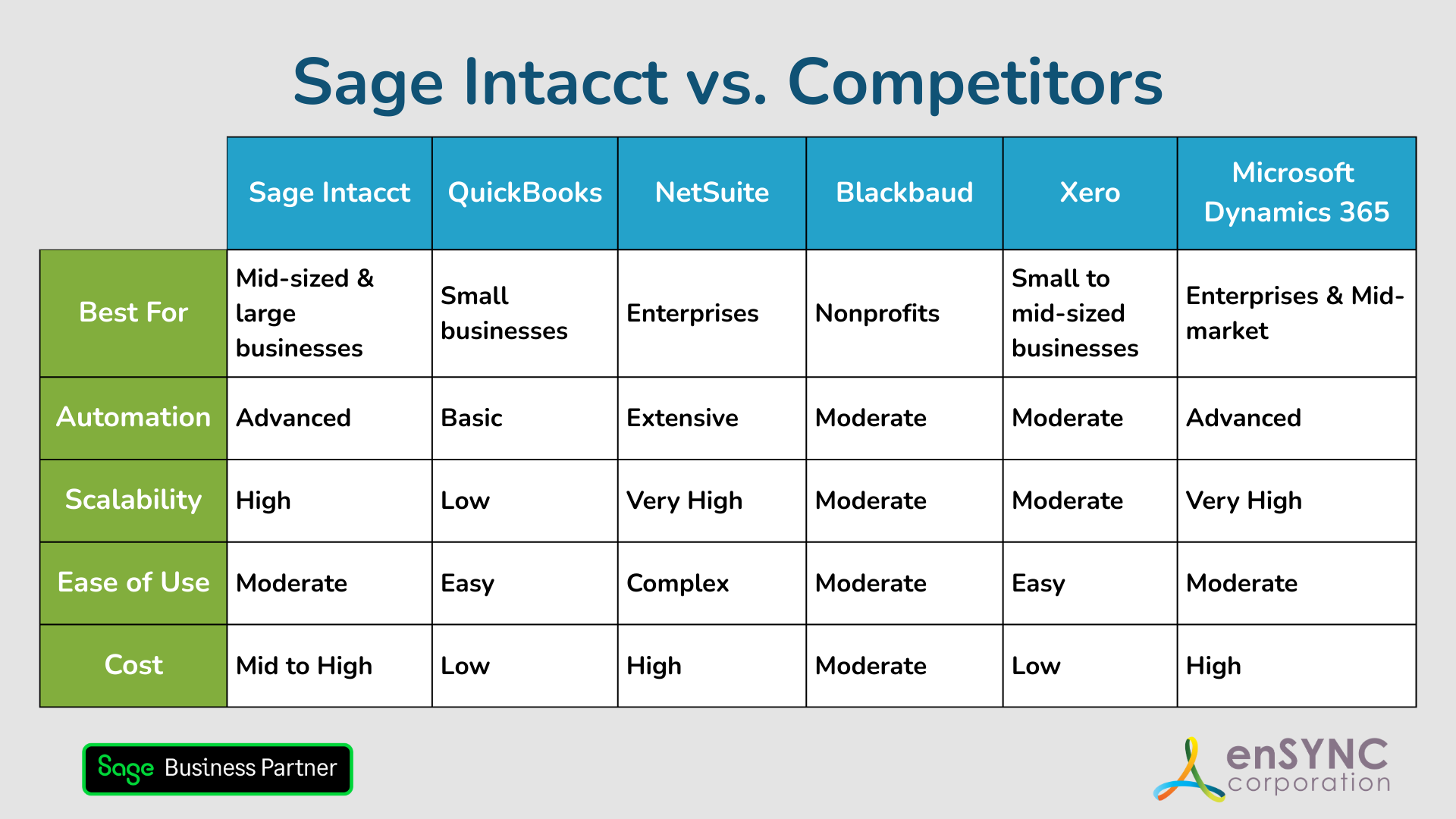

But where to start with accounting software? How do you know what’s right for you? Sage Intacct — alongside QuickBooks, NetSuite, Blackbaud, Xero, and Microsoft Dynamics 365 — offers software with various pros and cons. This guide compares these accounting software solutions to help you determine which best suits your organization’s specific needs.

Sage Intacct vs. Competitors Table of Contents

- Sage Intacct vs. Other Accounting Software Overview

- Key Questions to Ask When Choosing Nonprofit Accounting Software

- Sage Intacct Overview

- Sage Intacct vs. QuickBooks

- Sage Intacct vs. NetSuite

- Sage Intacct vs. Blackbaud (for Nonprofits)

- Sage Intacct vs. Microsoft Dynamics 365

- Pricing and Cost Breakdowns

- Choosing the Right Software

- Full Comparison Table of All Softwares

Sage Intacct vs. Other Accounting Software — A Comprehensive Comparison

The right accounting software will help your team beyond just financial management, including finding efficiencies, identifying areas for improvement, helping with strategic decision-making, streamlining tax and regulatory compliance, and more. “Many organizations overlook just how much outdated accounting software can end up slowing them down,” says Josh Kozinski, Director of Business Development at enSYNC. “In our experience, technology audits often reveal hidden bottlenecks and inefficiencies that could be easily resolved with more modern tools.”

When evaluating software, one of the first steps is to understand the size of your organization now — and where you expect it to be in the future. After all, a local startup organization will have different accounting software needs than an organization with international reach. Yet, a smaller organization on the precipice of massive growth might need accounting software that is more similar to that of a mid-size organization.

With that in mind, mid-sized organizations typically require more advanced accounting features but may not need the full capabilities (or price tag) of more robust software. Due to their broad features and scalability, software like Sage Intacct, NetSuite, Microsoft Dynamics 365, and Xero are common choices in this segment.

Key Questions to Ask When Choosing Nonprofit Accounting Software

- Scalability: Can the software grow with the organization?

- Features: Does it offer automation, integration, and customization?

- Ease of use: How user-friendly is the interface?

- Cost: What are the pricing structures and hidden costs?

- Industry-specific capabilities: Are there specialized features for your industry?

- Support and security: What level of customer support and security features are provided?

- Data integrity: How protected is your data? Does the software offer encryption and regular backups?

- Customer reviews: How do people like the software? What are users saying?

Sage Intacct Overview

Before diving into the competitors, here’s a quick rundown of Sage Intacct’s features, including some of its pros and cons.

Sage Intacct Is Best for:

Sage Intacct is ideal for growing or mid-sized organizations, typically with over $4 million in annual revenue or more than 20 employees. It offers fully scalable cloud accounting, payroll, and HR automation, advanced dashboards for financial visibility, integration with various other platforms, and interactive and collaborative reporting tools.

Sage Intacct Features:

- Cloud-based financial management with real-time data access

- Advanced reporting and analytics with customizable dashboards

- Multi-entity and multi-currency support for global operations

- AI-driven automation for accounts payable, receivable, and revenue recognition

- Strong integration with enterprise resource planning (ERP), customer relationship management (CRM), and third-party business applications

- HIPAA compliant

Pros of Using Sage Intacct:

- Highly scalable with robust financial management features

- Powerful automation, reducing manual data entry and errors

- Intuitive interface and easy customization abilities

- Comprehensive reporting and compliance tools for complex businesses, including custom dashboards and multi-dimensional reports

- Easy collaboration tools for internal teams and other business platforms and software

- High customer satisfaction rating on software review sites like G2

Cons of Using Sage Intacct:

- Higher cost compared to entry-level services

- Steeper learning curve, requiring training for full use

Sage Intacct vs. QuickBooks

QuickBooks is a well-known accounting software, especially popular among small businesses and startups. Many businesses start with QuickBooks due to its affordability, name recognition, and ease of use.

QuickBooks Is Best for:

Small to mid-sized businesses looking for a user-friendly and cost-effective solution.

QuickBooks Features:

- Cloud-based access for easy financial management

- User-friendly interface with simple navigation

- Strong integrations with payroll, tax management, and third-party applications

- AI-powered automation for transaction categorization

Pros of Using QuickBooks:

- Affordable pricing

- Easy to set up and use with minimal training

Cons of Using QuickBooks:

- Limited scalability

- Fewer advanced financial management features

- Limited account users

Quickbooks Vs. Sage Intacct Feature Comparison:

- Ease of Use: QuickBooks is more intuitive for beginners, whereas Sage Intacct can have a learning curve.

- Automation and AI: Sage Intacct offers more automation and AI-driven insights.

- Scalability: Sage Intacct is more scalable and integrates better with other business systems.

Who Should Choose Which?

- Choose QuickBooks if you run a small business or startup and need basic accounting.

- Choose Sage Intacct if you are a mid-sized or growing company that requires robust automation and real-time financial insights.

Sage Intacct vs. NetSuite

NetSuite is a comprehensive ERP solution, providing financing, reporting, and operations management.

NetSuite Is Best for:

Mid-to-large enterprises needing a full-suite ERP solution.

NetSuite Features:

- Comprehensive financial and enterprise resource planning capabilities

- Cloud-based software with real-time financial tracking

- Advanced reporting, analytics, and forecasting

- Highly customizable for different industries

- Integrated with CRM, inventory management, and HR systems

Pros of Using NetSuite:

- Extensive functionality for growing businesses

- Strong automation and AI-driven insights

- Scalable solution for enterprises

Cons of Using NetSuite:

- More traditional interface and designs, complicating some users’ navigation abilities

- High cost

- Requires professional implementation and training

NetSuite vs. Sage Intacct Feature Comparison:

- ERP vs. accounting focus: NetSuite offers more ERP capabilities, while Sage Intacct specializes in financial and accounting management.

- Customization: NetSuite allows for more extensive customization.

- Implementation and cost: NetSuite is more expensive and complex to implement.

- Collaboration and reporting: Sage Intacct offers greater real-time collaboration and interactive reporting tools.

Who Should Choose Which?

- Choose NetSuite if you need a complete ERP solution for a highly complex system.

- Choose Sage Intacct if you primarily require an advanced financial management system, more intuitive design and usability, and a lower cost.

Sage Intacct vs. Blackbaud (for Nonprofits)

Blackbaud is a cloud-based financial and fundraising management solution designed for nonprofits and education organizations. It helps streamline accounting, donor relations, and grant tracking.

Blackbaud Is Best for:

Nonprofits, foundations, and educational institutions looking for specialized financial and fundraising management solutions.

Blackbaud Features:

- Cloud-based accounting and donor management tools

- Grant and fund accounting to ensure compliance with nonprofit regulations

- Integrated fundraising, CRM, and donor relationship management

- Reporting and analytics tailored for nonprofits

- Automation for tracking grants, donations, and expenses

Pros of Using Blackbaud:

- Designed specifically for nonprofits with compliance-focused financial tracking

- Strong donor management and fundraising tools

- Scalable for small to large nonprofit organizations

Cons of Using Blackbaud:

- Higher pricing compared to entry-level accounting software

- Limited features compared to other software

- Can have a learning curve due to its specialized nonprofit features

Blackbaud vs. Sage Intacct Feature Comparison:

- Nonprofit-specific donor tools: Blackbaud provides more donor management tools.

- Financial reporting: Sage Intacct offers superior financial reporting.

- Grant and fund accounting: Sage Intacct provides comprehensive grant and fund accounting features, making it ideal for nonprofits and organizations managing multiple funding sources.

Who Should Choose Which?

- Choose Blackbaud if donor management is your priority.

- Choose Sage Intacct for more advanced financial automation and reporting. Sage Intacct’s largest industry focus is the nonprofit sector.

Sage Intacct vs. Xero

Xero is a cloud-based accounting software for smaller and medium-sized businesses, offering a simple user interface, low price point, and easy integration with third-party apps.

Xero Is Best for:

Small to mid-sized businesses, startups, and freelancers seeking an easy-to-use, cloud-based accounting solution with strong automation and integration features.

Xero Features:

- Cloud-based access with real-time financial data updates

- Automated bank feeds and transaction reconciliation

- Invoicing, expense tracking, and multi-currency support

- Integration with over 1,000 third-party apps, including payroll and tax software

- Customizable financial reports and dashboards

Pros of Using Xero:

- User-friendly interface

- Plans support unlimited users

- Strong automation features for reducing manual data entry

- Scalable with various pricing plans for growing businesses

Cons of Using Xero:

- Limited customer support options compared to competitors

- Lacks advanced financial management features needed for larger enterprises

- Difficult invoicing system

Xero vs. Sage Intacct Feature Comparison:

- Starting point: Xero is easier to use and less expensive for small businesses.

- Reporting and automation: Sage Intacct offers superior reporting and automation.

- Scalability: Sage Intacct scales better for larger businesses.

Who Should Choose Which?

- Choose Xero if you are a small business looking for ease of use.

- Choose Sage Intacct if you need in-depth financial reporting and automation.

Sage Intacct vs. Microsoft Dynamics 365

Microsoft Dynamics 365 is a cloud-based set of applications offering full ERP and CRM capabilities alongside other Microsoft products.

Microsoft Dynamics 365 Is Best for:

Mid-sized businesses that rely on Microsoft products and require a combination of accounting and ERP features.

Microsoft Dynamics 365 Features:

- Cloud-based apps with strong security features

- Integrated financial management and business intelligence tools

- AI-driven insights for financial forecasting

- Seamless integration with Microsoft 365 products (Excel, Outlook, Teams, etc.)

Pros of Using Microsoft Dynamics 365:

- Strong integration with Microsoft ecosystem

- Scalable solution suitable for growing businesses

- Full ERP capabilities

- Customizable for industry-specific needs

Cons of Using Microsoft Dynamics 365:

- Higher learning curve compared to simpler accounting software

- Can be expensive for smaller businesses

- User interface can be difficult to use

- Reporting can be slower, including having to rely on manual consolidations

Microsoft Dynamics 365 vs. Sage Intacct Feature Comparison:

- Integration with Microsoft products: Dynamics 365 integrates well with all Microsoft products.

- Accounting focus: Sage Intacct provides better accounting-specific features.

- Ease of use: Sage Intacct offers a more accessible user interface.

Who Should Choose Which?

- Choose Microsoft Dynamics 365 if you use Microsoft products extensively.

- Choose Sage Intacct if you need a scalable financial management solution that’s easy to use.

Sage Intacct vs. Other Software: Pricing and Cost Breakdown

How much does Sage Intacct cost? How much do competitors cost? While prices vary based on users and modules, Sage Intacct pricing starts around $10,920 per year or about $910 per month. Here’s an overview of costs for other services:

- QuickBooks: Ranges from $35 to $235 per month, depending on the plan.

- NetSuite: Pricing starts at around $999 per month, with additional user fees and implementation costs.

- Blackbaud: Varies significantly based on nonprofit size and needs, typically starting at $99 per month for basic plans, with options up to $999 per month.

- Xero: Starts at $20 per month for basic plans, with higher tiers reaching $80 per month for advanced features.

- Microsoft Dynamics 365: Starts at around $70 per user per month, with additional costs for premium modules and customizations.

Perpetual Licenses vs. Subscriptions

Most modern solutions, including Sage Intacct, use subscription-based pricing rather than perpetual licenses. The subscription model is typically paid monthly or annually. Perpetual licensing is a one-time cost that grants users lifetime access.

Hidden Costs of Accounting Software to Consider

- Implementation fees: Many accounting solutions require an upfront cost for implementation, which can include data migration, system configuration, and initial training.

- Customization and add-ons: Some software companies may charge additional fees for custom modules, third-party integrations, and industry-specific features.

- Training and support: Ongoing training and premium customer support options often come at an extra cost, which businesses should factor into their total budget.

Which Nonprofit Accounting Solution is Most Cost-Effective?

The best value depends on organization needs, but Sage Intacct offers strong returns for mid-sized organizations looking for automation, scalability, easy interfaces, collaboration, and more. “When evaluating accounting software, it’s important to consider the total cost — not just the price tag,” says Kozinski. “Solutions with steep learning curves require more time and training, and outdated systems can build up technology debt that’s expensive to fix down the road. Seeing the full picture helps ensure your decision is based on long-term value, not just short-term cost.”

Choosing the Right Software

Choosing the right accounting software depends on your organization's size, industry, and financial management needs. For instance, QuickBooks and Xero are ideal for small businesses, while NetSuite and Microsoft Dynamics 365 serve broader ERP needs. Blackbaud is suited for nonprofits, whereas Sage Intacct offers a balance of robust financial management and scalability across all these areas.

Comparison Table Summarizing Sage Intacct vs. Other Popular Nonprofit Accounting Software

Meet Josh Kozinski, the Director of Business Development at enSYNC. With expertise in Sage Intacct, iMIS, and supporting technologies, Josh's mission is to simplify complex processes by transforming rogue spreadsheets and databases into streamlined, automated solutions. His dedication to delivering strategic solutions aligns perfectly with enSYNC's commitment to efficient and innovative nonprofit management. Josh is not just a leader at enSYNC; he's actively involved in prominent industry organizations. By staying connected with these networks, Josh remains at the forefront of industry trends and best practices. In addition to his professional pursuits, Josh serves on the Board of Directors for the Dallas Fort Worth Association Executives, giving back to the industry he's passionate about. Away from the office, Josh is an athlete at heart. He pursued his college education at Central Michigan, where he played basketball. However, what Josh values most is his relationships with his family and his faith in God. Josh is always open to discussions, whether you're seeking innovative solutions for nonprofit management, exploring industry trends, or simply connecting with like-minded professionals.

Recent Posts

Sage Intacct vs. Competitors: Finding the Best Accounting Solution for Your Nonprofit

Choosing the right accounting software is a critical step for any organization — and a deeply personal one, too. How to choose the accounting...

How Sage Intacct Transforms Nonprofit Financial Management: A Complete Guide

Staying on top of financial management is crucial for all businesses, especially nonprofits. Nonprofits often have limited resources and handle...

Enjoying our blog?

At enSYNC, we want to empower associations and nonprofits to make well-educated decisions. If you want our industry knowledge (and other free guides) sent directly to your inbox, fill out the form below.