Strategy & planning | Senior living | Financial management

The Dos and Don'ts of Developing a Financial Plan for Senior Living

September 11, 2024

|

Senior living communities face unique challenges — from fluctuating occupancy rates to regulatory compliance. However, developing a financial plan helps offset these risks. Financial stability ensures members receive quality care while allowing the organizations to adapt to a changing landscape.

A financial plan for senior living organizations serves as a roadmap by clarifying resource allocation and helping others make informed housing, staff, and investment decisions. Combined with additional insights from tools like Sage Intacct reporting, your financial plan serves as a communication tool, allowing stakeholders to grasp the organization's financial health and strategic direction.

Do: Understand the Basics of Financial Planning

Understanding the foundations of successful financial planning can help set your team up for success. The basics of developing a financial plan include budgeting, forecasting, and reporting — each playing an important role.

- Budgeting: A detailed plan for managing income and expenses. Senior living means accounting for a variety of costs from staffing to operations and resident services. Accurate budgeting helps your organization meet its financial obligations and make investments that will improve resident care.

- Forecasting: Predict future financial performance based on historical data and market trends. This includes predicting changes in occupancy rates, operating costs, and regulations. Forecasting allows organizations to prepare for potential challenges and seize growth opportunities.

- Reporting: Provide a clear picture of the organization's financial status. Tools like Sage Intacct reporting offer real-time insights that help managers make informed decisions with accurate and timely reports.

Do: Craft a Strategy for Financial Success

Don't create a financial plan simply because — there needs to be a strategy behind it, with clear goals, identified key performance indicators (KPIs), and action plans. A strategic financial plan aligns with the organization's mission and vision, ensuring that every decision supports its long-term goals.

Start by assessing your organization's financial position, including revenue streams, cost structures, and needs. Set realistic and achievable goals off of that baseline, such as increasing profitability or expanding services.

Next, identify KPIs. KPIs are not just numbers. They set guidelines that help organizations track their progress. For senior living communities, KPIs may include:

- Occupancy rates.

- Staff-to-resident ratios.

- Operating margins.

By regularly monitoring these indicators, organizations can identify areas for improvement and adjust accordingly, giving a clear sense of direction and purpose.

Don't: Underestimate Market Analysis

Market analysis is critical to any financial plan for senior living organizations. Understanding market trends, competitor strategies, and demographic shifts allows organizations to position themselves strategically and capitalize on new opportunities.

Market analysis examines local competition, consumer preferences, and regulatory changes in your industry. It can identify emerging trends and potential threats.

Don’t: Forget About Your Target Audience

Another area is identifying the needs and preferences of your members. This includes understanding members and their families' most valued services and amenities to attract and retain them by aligning offerings with market demand.

Don't: Forego Leveraging Technology

Technology is pivotal in financial planning. Advanced software solutions like Sage Intacct reporting offer powerful budgeting, forecasting, and reporting tools, enabling senior living organizations to streamline processes and improve accuracy. Here’s how:

- Software automates complex calculations, reducing the risk of human error and saving valuable time. This means financial plans for senior living organizations can focus on strategic analysis rather than manual data entry.

- Sophisticated modeling capabilities allow organizations to simulate different scenarios and assess their potential impact. This enables financial planners to anticipate changes in the market and adjust accordingly, ensuring that the organization remains agile and resilient.

- Real-time access to financial data gives managers a clear picture of the organization's financial health daily rather than monthly or quarterly. With customizable dashboards and automated reporting features, financial planners can quickly generate insights and share them with stakeholders, facilitating informed decision-making and enhancing transparency.

The Ultimate Financial Plan for Senior Living Organizations

The key is to strike a balance between strategic planning and adaptability so that your organization can respond to changes in the market and continue to thrive. When developing a financial plan, don't rule out technology; conduct a thorough market analysis and stay resilient to position your organization for growth.

Interested in Exploring Developing a Financial Plan Further? enSYNC Can Get You Started.

Partnering with the right technology provider ensures that your financial plan is seamlessly aligned with your tools and processes.

Chadd Arthur is a seasoned professional with over 25 years of experience in the non-profit sector, specializing in process improvement and the strategic alignment of organizational goals with technology solutions. Leveraging his extensive expertise, Chadd conducts regular strategic assessments for organizations, guiding them towards enhanced efficiency and effectiveness. With a profound passion for aiding clients in recognizing the value of process improvement, Chadd leads our team in secure technology solutions that directly contribute to their mission success. His commitment to excellence is evident in his contributions to the industry, including participating in panels and serving as a thought leader to a network of non-profit professionals. Chadd earned his MBA from Indiana University Bloomington and resides outside the greater Chicago area. Chadd not only brings a wealth of knowledge and experience but also a dedication to making a meaningful impact in the non-profit space.

Recent Posts

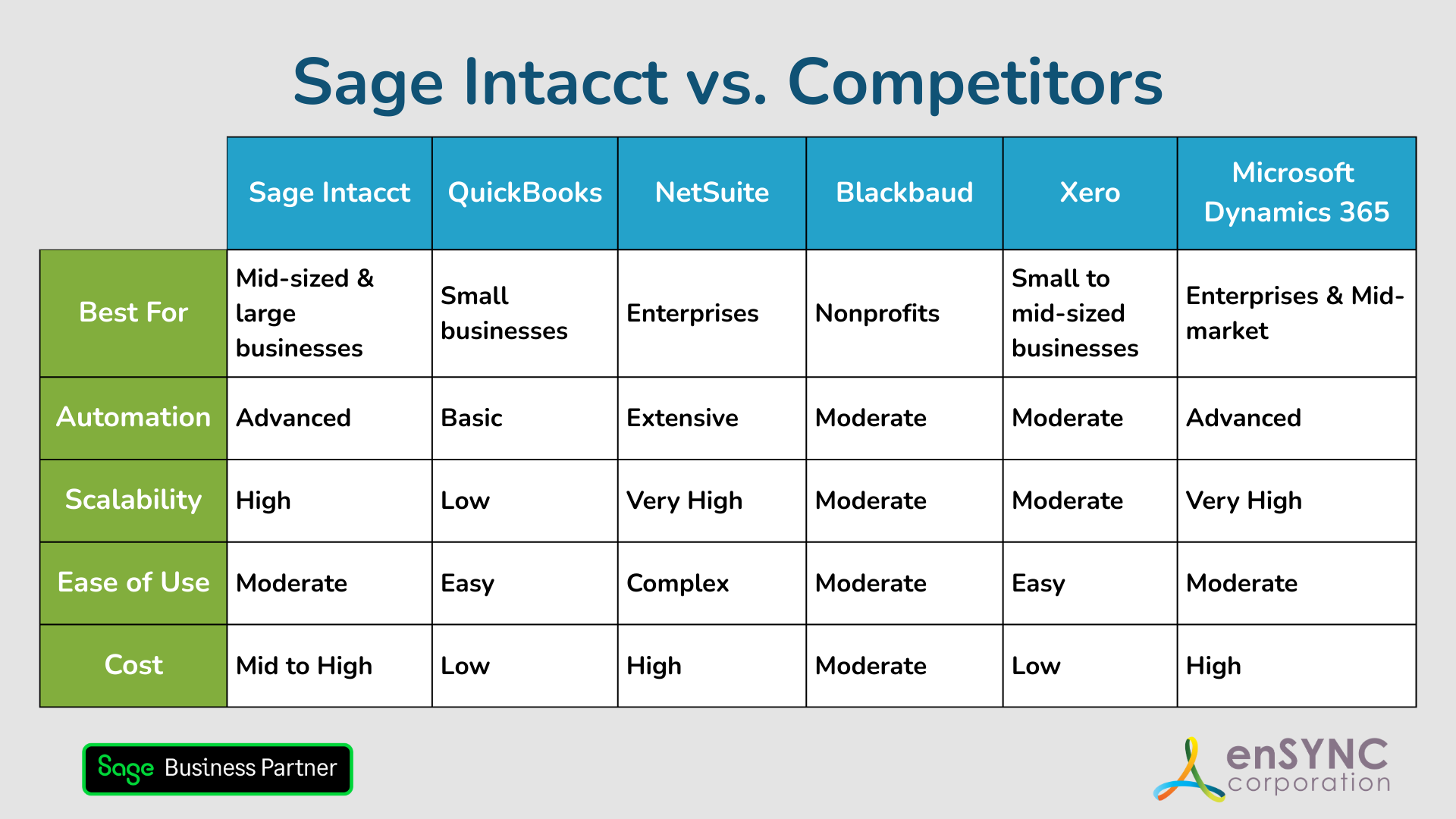

Sage Intacct vs. Competitors: Finding the Best Accounting Solution for Your Nonprofit

Choosing the right accounting software is a critical step for any organization — and a deeply personal one, too. How to choose the accounting...

How Sage Intacct Transforms Nonprofit Financial Management: A Complete Guide

Staying on top of financial management is crucial for all businesses, especially nonprofits. Nonprofits often have limited resources and handle...

Enjoying our blog?

At enSYNC, we want to empower associations and nonprofits to make well-educated decisions. If you want our industry knowledge (and other free guides) sent directly to your inbox, fill out the form below.