Imis | Merchant processing | Software solutions | Nonprofits & associations | Financial management

Start Saving Money with Clover’s Credit Card Fees (Formerly CardConnect)

April 4, 2023

|

Successful nonprofit financial managers understand that optimizing budgets is a never-ending process.

So how about an idea that saves your nonprofit money while improving the payment experience for your members?

Clover makes it easy with fully customizable payment processing and point-of-sale systems that can save your organization up to 15% in credit card fees. What’s more, enSYNC’s iMIS integrations simplify payment processing while giving your members more ways to pay for products and services.

Why Clover?

Clover is an all-in-one payment processing system with everything your organization needs to start taking payments right away: POS hardware and software, a virtual terminal, and the Clover App Market with over 100 applications to help you run your business.

Clover systems are also easily accessible, starting at $14.95 per month for software that runs on your browser.

Need to take payments on the go? No problem! Clover’s standard systems start at $49 + $14.95 per month, and advanced systems cost $599 + $14.95 in monthly fees.

Other systems include:

-

Clover Mini - a small handheld device with a touch screen and built-in receipt printer that allows customers to enter payment details. It also connects to other devices like barcode scanners, weight scales, and cash registers.

-

Clover Flex - a handheld POS system with a 6-inch touchscreen, camera, built-in printer, and barcode scanner. It accepts numerous payment types, including swipe, tap, dip, and contactless payments.

-

Clover Station Solo - an all-in-one comprehensive POS system that accepts swipe, tap, dip, and contactless payments. Staton Solo also comes with a cash drawer, receipt printer, and tools to help track inventory and produce reports with valuable financial insights.

These systems are just a sample of what Clover offers. To get customized recommendations, contact us to schedule a complimentary call to review options that are best suited to your nonprofit’s needs and budget.

Reducing Fees and Increasing Revenue Needs a Strategy

enSYNC understands that nonprofits and associations operate differently. We’ve been helping organizations unlock the power of technology to reduce expenses, increase revenue, and boost productivity for over 25 years.

Contact us to schedule a free assessment to learn how modern software helps your organization thrive on the new technological landscape.

How to Integrate iMIS and Clover

iMIS is a cloud-based membership engagement system specifically designed for nonprofits and associations. Features include tools to manage members, fundraising campaigns, marketing, events, continuing education, advocacy, and much more.

If you aren’t already using iMIS, click here to learn more about how it can improve productivity, increase efficiency, boost engagement, and enhance member services.

Optimizing the payment experience is critical to driving sales.

Member-based organizations that optimize payment services typically experience higher renewal rates and increased sales for events, merchandise, and continuing education. That’s because outdated or “free” payment systems often look unprofessional, decrease consumer confidence, and result in lost sales.

To help nonprofits and associations streamline the payment experience, enSYNC developed a suite of products to integrate Clover with iMIS, including:

RefundXpress

RefundXpress is a small module that allows you to process refunds without requiring the customer’s credit card information. Instead, RefundXpress uses the gateway's encrypted transaction token to reference the purchase.

Clover Express Checkout

Clover Express Checkout is a payment gateway page that is similar to Paypal. The module is ideal for organizations with only a few products or professional services because it doesn’t require investment in a full ecommerce store. Besides facilitating customer payments, Clover Express Checkout is ideal for small organizations because it doesn’t subject them to a PCI audit.

eCheck Functionality

enSYNC’s eCheck software allows customers to pay via ACH. Once installed, customers can access the module on the RiSE cart page and input their banking information to pay directly from their bank account.

Benefits of Clover for Nonprofits and Associations

Implementing Clover into your payment processes has many benefits that include:

Clover has everything nonprofits and associations need to start accepting payments.

Clover is an all-in-one payment solution that enables you to accept credit and debit cards right away, including:- POS hardware and software

- Payment processing capabilities to process payments from both physical and online stores on a single interface

- Inventory management tools

- Business management tools such as reporting, sales tracking, and employee management software

Clover gives your members multiple ways to pay.

Clover's payment processing system accepts all major credit and debit cards, including chip cards and contactless payment methods. Clover additionally improves the online ordering experience by offering a customer-facing module and a virtual terminal for online payment processing.

Clover helps nonprofits and associations save big on credit card fees.

Nonprofit and small business managers know that high credit card transaction fees can really hit their bottom line. Clover helps offset those expenses with flat-rate processing that starts at 2.3% + $0.10 per retail transaction. In addition, pricing plans start at $14.95 per month and services scale up easily as your business grows.

Clover is easy to use.

Clover has a user-friendly, intuitive interface that is easy to use. In addition, the system has numerous add-ons that help you process payments, track sales, generate reports, manage inventory, and more.

Clover’s services can be customized to your nonprofit or association.

enSYNC understands that nonprofits and associations work differently than typical businesses. Clover’s software can easily be customized to your organization with tools to create discount programs, modify the interface, and create customized reports tailored to your stakeholders.

Clover is secure.

Data breaches are frequently in the news because they are rising, with severe consequences for organizations of all sizes.

A security breach costs significant resources to mitigate and control. Further, it can result in membership losses and irreversible harm to your organization’s reputation.

Clover’s systems protect your member’s sensitive information by complying with all standards set by the Payment Card Industry Security Standards Council (PCI SSC). PCI SSC standards include fraud detection, encryption, and tokenization.

How Payment Processing Works

Online payment processing facilitates transactions between buyers and sellers through various services offered by external parties. These companies collaborate at every stage of the transaction to ensure the secure flow of data within the system. Current payment channels supported include all major credit cards, debit cards, gift cards, contactless payments, and ACH.

The payment processing ecosystem includes the following five groups:

Acquirers and Processors

Acquirers handle electronic payments by connecting merchants to payment networks like Mastercard, American Express, and Visa. Some acquirers additionally provide payment processing software and hardware, and manage the transfer of funds to the merchant's bank account.

Processors act as intermediaries between the payment network and the acquirer. They are responsible for routing, authorization, transaction settlements, and implementing enhanced security protocols to safeguard sensitive data.

Card Networks

Card networks are companies that provide the infrastructure required for customers to pay for goods and services. Examples include Visa, Mastercard, American Express, Discover, and UnionPay.

Issuers

Issuers are intermediaries that collect payment from cardholders for approved transactions. Following payment collection, issuers forward the funds to the acquirers. Examples include Wells Fargo, Bank of America, JPMorgan Chase, Citigroup, and Capital One.

Gateways

Gateways are software applications that connect the customer’s shopping cart, point of sale system, or virtual terminal to the card networks, payment processors, and customer banks. By acting as a bridge between these parties, gateways enable secure data transfer to the acquirer or payment processor for verification and settlement.

Gateways can also perform other functions like currency conversion, fraud detection, and analytics reporting. Examples include Stripe, PayPal, and Authorize.net.

MSPs/ISOs

Merchant Service Providers (MSPs) and Independent Sales Organizations (ISOs) are third-party firms that work with acquirers and payment processors to provide services that include:- Merchant account setup and management

- Provision of payment terminal and hardware systems

- Payment processing and settlement

- Value-added services such as fraud prevention, chargeback management, and transaction reporting

Examples include First Data, Elavon, and Global Payments.

Is Clover payment processing secure?

Clover systems ensure the security of customer data by implementing the following standards set by the Payment Card Industry Security Standards Council (PCI SSC):

-

Establishing and maintaining a secure network through measures that include: data encryption, firewall implementation, and security protocols that limit access to sensitive data.

-

Cardholder data protection via access controls, encryption, security system testing, and system monitoring

-

Creation and maintenance of a vulnerability management program

-

Robust access control measures, including two-factor authentication, assigning unique user IDs, and restricting physical access to cardholder data

-

Regular network monitoring and testing, including the implementation and maintenance of an incident response plan, tracking and monitoring access to cardholder data, and network testing

Compliance with PCI DSS standards is compulsory for all companies in the payment processing ecosystem, and non-compliance leads to severe fines and penalties. Clover adheres to all PCI DSS standards to guarantee the security of customer data.

Implementing Clover is easy with enSYNC.

Ready to get started with Clover? Implementing the software is easily accomplished with the following four steps:

Step One: Assessment and Analysis

First, we collect merchant statements from your organization and have Clover perform a statement analysis. Once the analysis is completed, we’ll set up a presentation call to introduce you to a Clover representative that will present your assessment results.

Step Two: Application and Underwriting

Next, Clover sends you an application. Once completed, the underwriting process begins. This step typically takes 3-5 business days to complete.

Step Three: Implementation and Training

Following the underwriting process, we’ll schedule an implementation and training session. Expect to spend 1-2 hours on implementation and 30 minutes on training.

Step Four: After-Sales Support

Once the implementation process is completed, Clover assigns a representative to answer any questions and provide ongoing support.

Reduce fees, boost sales, and improve the member experience with Clover.

Clover is an industry-leading payment processing solution that has everything you need to process payments, including hardware, software, a virtual terminal, and a suite of apps to help run your business.

enSYNC connects Clover to iMIS with a suite of integrations that simplify refunds and streamline the payment experience. Ready to start saving on credit card fees? Contact us for a free assessment to learn more.

Shannon isn't afraid to get out of her comfort zone and continuously gives our team here support and motivation. She has a degree in marketing and through this, she has found a passion in digital media.

Recent Posts

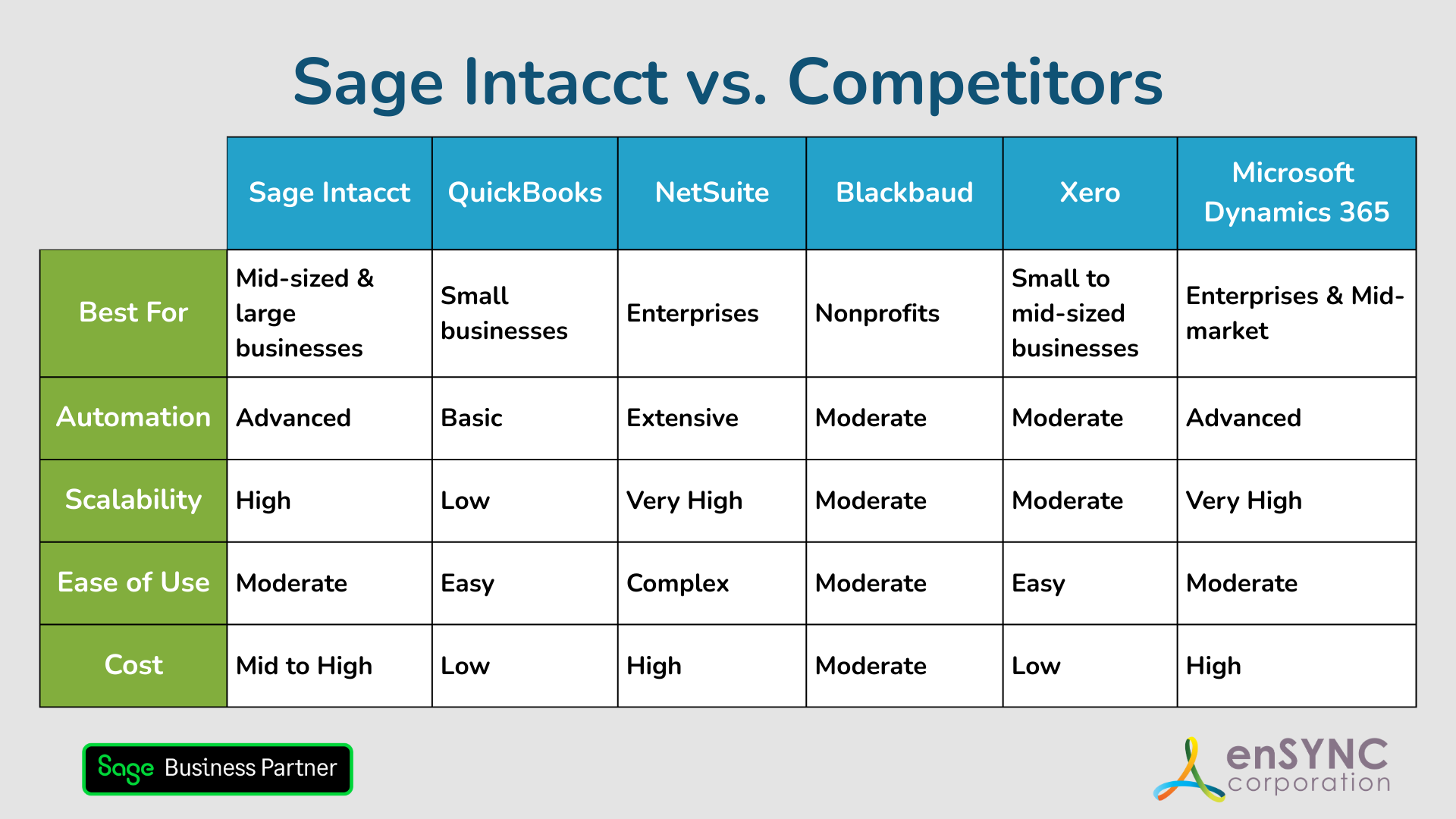

Sage Intacct vs. Competitors: Finding the Best Accounting Solution for Your Nonprofit

Choosing the right accounting software is a critical step for any organization — and a deeply personal one, too. How to choose the accounting...

How Sage Intacct Transforms Nonprofit Financial Management: A Complete Guide

Staying on top of financial management is crucial for all businesses, especially nonprofits. Nonprofits often have limited resources and handle...

Enjoying our blog?

At enSYNC, we want to empower associations and nonprofits to make well-educated decisions. If you want our industry knowledge (and other free guides) sent directly to your inbox, fill out the form below.