Webinar | Grant & fundraising | Nonprofits & associations | Financial management

Quick Guide: How To Choose Nonprofit Accounting Software

May 10, 2023

|

With so many options available today, choosing an accounting software solution for your nonprofit can be a time-consuming and overwhelming process.

This guide is designed to help you avoid information overload, gain clarity, and save time.

You’ll learn how nonprofit accounting differs from regular accounting, and what software features overcome your most common challenges. Lastly, we’ll go over how to choose the right solution for your nonprofit organization.

So let’s get started.

How Nonprofit Accounting Differs From Regular Accounting

The primary difference between nonprofits and regular businesses is their purpose. Profit-seeking entities typically exist to provide goods and services while accruing wealth to their owners or shareholders.

In contrast, nonprofits are meant to operate for the public good. In return, they receive a privileged tax-exempt status and must file a Form 990 each year.

Nonprofits are also subjected to unique compliance and reporting requirements to maintain their special status. As a result, nonprofit financial management and accounting functions differ in several ways that include:

Fund Accounting

Fund accounting is a type of accounting system that tracks and reports the accounting activity of a particular fund or program. Nonprofits typically use this system because they often have restrictions and requirements that tie funds to specific purposes.

Fund accounting enables nonprofits to ensure that resources are used in accordance with the rules and regulations of funding organizations, donors, or the government. Each fund is treated as a separate entity with its own procedures, accounts, and financial statements. This enables teams to account for revenues and expenses for each fund separately according to the regulations or restrictions governing each entity.

Tax Treatment of Revenue

Regular businesses typically rely on income from the sale of goods or services. In contrast, nonprofits depend on multiple revenue sources with different tax treatments, including:

Donations and Grants:

Donations and grants are typically the primary source of revenue for most nonprofits. These funds usually come from foundations, corporations, individuals, and the government — and are generally tax-deductible.

In-Kind Donations:

In-kind donations are gifts consisting of goods or services instead of money. For example, a department store may donate clothing to a shelter, or a restaurant may provide free food for an event. While these donations are not tax-deductible, they help lower costs for the organization’s events and programs.

Fundraising Events:

Fundraising events such as marathons, auctions, and galas help nonprofits generate revenue and raise awareness of the organization’s programs. Donations raised during these events are tax-deductible, however ticket sales and sponsorships are usually subject to taxes.

Membership Fees:

Many nonprofits offer membership programs to donors with services that include discounts with partner businesses, access to resources, admission to events, and other services. Revenue derived from membership fees is typically not tax-deductible.

Program Service Fees:

Nonprofits such as hospitals often charge fees for some services. In most cases, income earned from some of these services is not tax-deductible.

Investment Income:

Nonprofit organizations, such as teachers’ unions, invest money from pension funds to generate a future return. Revenue generated this way is not tax-deductible.

Revenue Recognition

Nonprofits are subjected to different accounting guidelines. As a result, they recognize revenue in alternative ways that include:

Nonprofits recognize contributions as revenue when received.

Regular businesses recognize revenue after delivering a product or service. In contrast, nonprofits report contributions as revenue upon receipt because no product or service is offered in return.

Revenue recognition is different for restricted and unrestricted funds.

Most nonprofits have restrictions on how donations and grants are used. As a result, restricted funds are recognized once conditions are met while unrestricted funds are reported once received.

Program and support revenue streams are reported differently.

Nonprofits usually earn revenue from programs, marathons, galas, and other fundraising events. Revenue from these different sources may be recognized at different times, depending on the activity and accounting guidelines followed by the organization.

Expense Allocation

The US Internal Revenue Service (IRS) requires that nonprofits assign expenses based on their direct or indirect relation to program activities. As a result, nonprofits use a system called program cost allocation that (a) identifies direct costs associated with each program, (b) allocates indirect costs, and (c) periodically reviews and adjusts expenses when required.

Financial Reporting

Like most businesses, nonprofits must comply with financial reporting requirements on an annual and quarterly basis. This involves producing nonprofit financial statements such as a balance sheet, income statement, and statement of cash flows.

Compliance Requirements

Nonprofit organizations are subjected to different accounting guidelines established by regulatory organizations such as the International Financial Reporting Standards (IFRS) and the Financial Accounting Standards Board (FASB). In addition, they have compliance requirements associated with their grant funding and tax-free status.

5 Software Features That Benefit Nonprofits

Nonprofits have unique accounting requirements that require specialized nonprofit software features, including:

Fund Accounting

Nonprofits typically use fund accounting to manage their financial resources. As a result, they require fund accounting software that tracks the accounting activity of programs or individual funds, and meets the reporting requirements of grantors and donors.

Donation Management

Most nonprofits rely on revenue from donations, and need nonprofit accounting software that enables them to track and manage contributions. Nonprofits also require software that integrates with online payment systems to process debit and credit card transactions.

Many nonprofits also depend on donor management software to produce online donation forms, manage donor data, send acknowledgment letters, and track donor history. As a result, most would benefit from software that integrates with donor management systems to reduce data entry, save time, and minimize repetitive tasks.

Grant Management

Many nonprofits depend on grants to fund their programs. Accounting systems that include grant management software features support teams throughout the entire grant lifecycle by enabling them to:

- Estimate the necessary funding to cover program expenses

- Forecast potential program impacts

- Produce budgets and track actuals in real time

- Generate customized reports with critical nonprofit financial metrics

- Automate workflows, set milestones, assign responsibilities, and schedule tasks

- Monitor progress with customized dashboards using real-time data

Customized Reporting

Nonprofits are accountable to numerous stakeholders, including donors, government agencies, and grant-funding organizations. As a result, nonprofits benefit from tools that allow them to create customized reports with the push of a button.

Software Integrations

Most nonprofits use other software systems, such as customer relationship management (CRM) systems, learning management applications, and fundraising management software. Integrating with these other systems increases transparency and provides a comprehensive view of the organization’s financial health.

Robust Security and Access Controls

Nonprofits typically deal with sensitive data and require software from a reputable provider that implements strict security protocols. In addition, the software should also have comprehensive access controls that enable managers to set role-based permissions throughout the organization.

How to Choose the Right Accounting Software Solution

Choosing the best software for your nonprofit organization requires a thorough analysis of your requirements, team capabilities, and budget.

Some key factors to consider during the selection process include:

- Required features

- Scalability

- Subscription and implementation costs

- Learning curve

- Integration capabilities

- Support services

- Security features

In summary, the right solution balances all these factors while giving your team the tools to improve efficiency, increase productivity, and enhance collaboration. That way, they can allocate effort to initiatives that contribute positively to your organization’s objectives and goals.

Sage Intacct vs. Quickbooks

Quickbooks and Sage Intacct are both leading accounting solutions that feature basic accounting features, including:

- General ledger

- Chart of accounts

- Accounts receivable

- Accounts payable

- Revenue and expense tracking

- Bank reconciliations

- Report generation

While both solutions have these common aspects, the similarities end there.

Sage Intacct takes nonprofit accounting up a notch with unique features that include:

- Nonprofit-specific reporting

- Donor management

- Fund accounting

- Grant management

- Advanced budgeting tools

- Customized reports

In addition, Sage Intact offers integrations that sync the software with popular nonprofit systems like iMIS, VoterVoice, TopClass, and more.

In summary, Quickbooks provide standard accounting features suitable for small to mid-sized businesses. In contrast, Sage Intacct’s advanced functionalities are customized to help nonprofits maximize their impact and achieve long-term success.

Level up with cloud-based software customized for nonprofits.

Ditch the legacy software and take your accounting operations up a notch with a modern financial system designed to help your organization grow.

The experts at enSYNC can show you how. For over 25 years we’ve helped nonprofits reach their maximum potential with the power of technology. Contact us to schedule a free demo to see what you’ve been missing.

Recent Posts

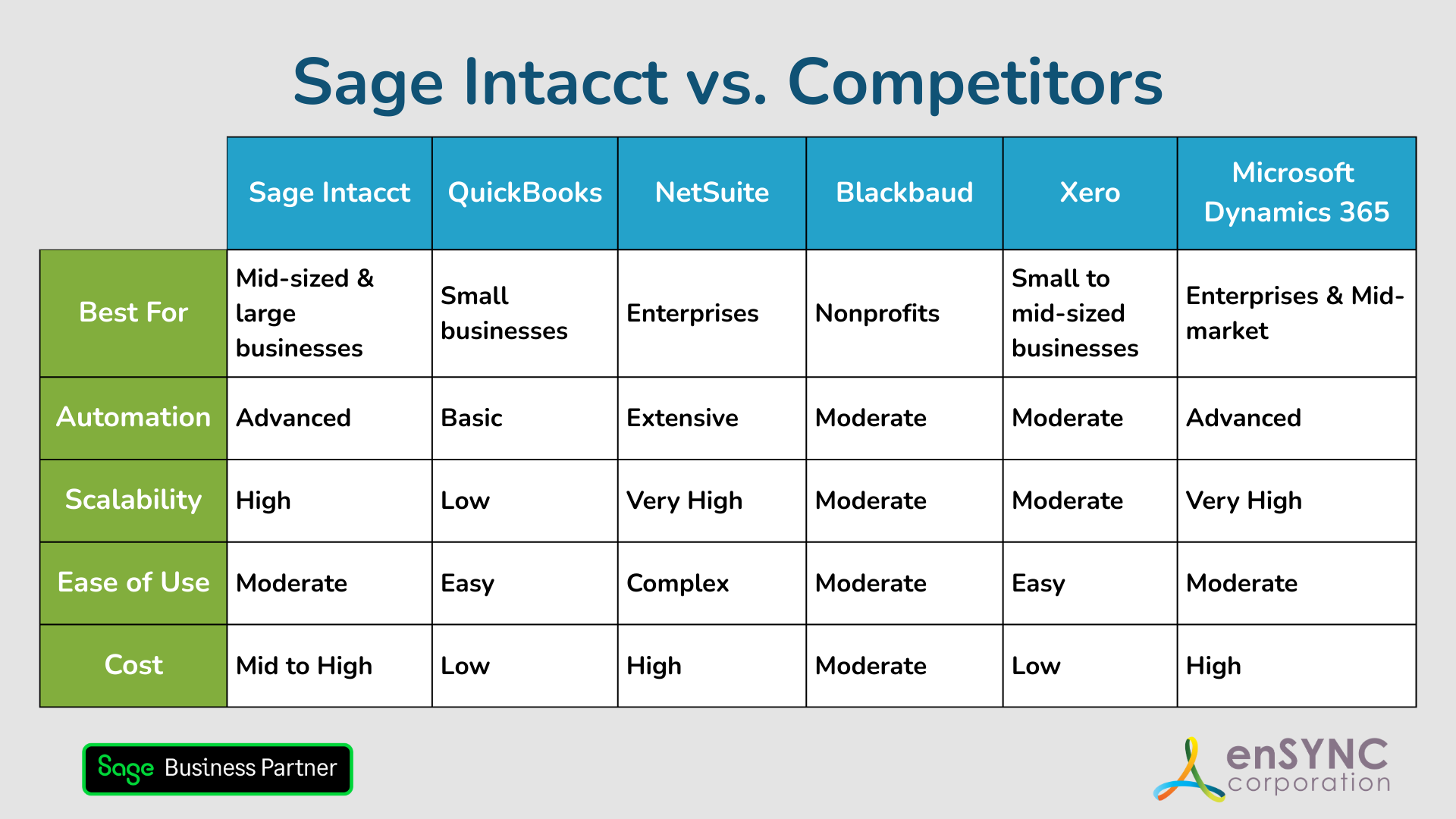

Sage Intacct vs. Competitors: Finding the Best Accounting Solution for Your Nonprofit

Choosing the right accounting software is a critical step for any organization — and a deeply personal one, too. How to choose the accounting...

How Sage Intacct Transforms Nonprofit Financial Management: A Complete Guide

Staying on top of financial management is crucial for all businesses, especially nonprofits. Nonprofits often have limited resources and handle...

Enjoying our blog?

At enSYNC, we want to empower associations and nonprofits to make well-educated decisions. If you want our industry knowledge (and other free guides) sent directly to your inbox, fill out the form below.